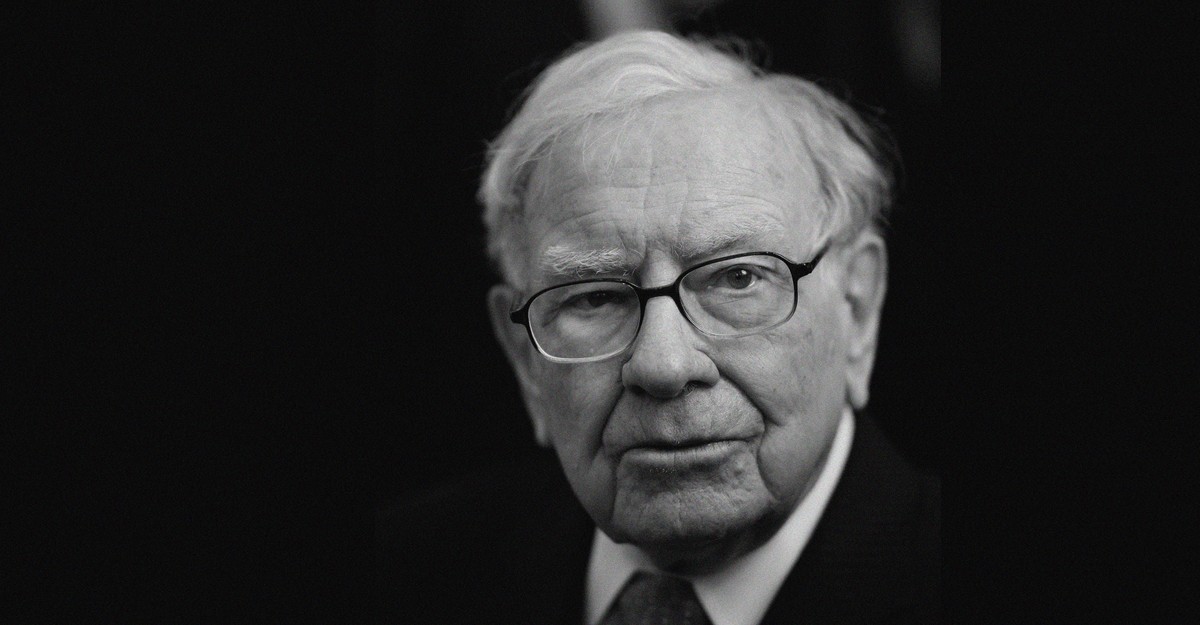

The End of an Era: Reflecting on Warren Buffett’s Unparalleled Legacy and What It Means for the Future of Investing

The investment world is bracing for a notable shift. Warren Buffett, the “Oracle of Omaha,” is stepping back from his day-to-day leadership of Berkshire Hathaway at the end of 2025, though he will remain Chairman. This isn’t simply a change in corporate leadership; it’s the passing of a torch, the dimming of a guiding star for generations of investors. And, frankly, it’s a moment that demands reflection on a career that redefined value investing and, perhaps more importantly, demonstrated a rare integrity in a world often driven by short-term gains.

For decades, Buffett has been more than just a successful investor; he’s been a moral compass. his influence extends far beyond the staggering $650 billion in shareholders’ equity Berkshire Hathaway is projected to command by 2025 – a figure that underscores his remarkable ability to generate wealth over the long term.

Defying the Laws of Financial Gravity

The conventional wisdom in finance dictates that size hinders performance. As a fund grows larger, it becomes increasingly difficult to find investments capable of moving the needle. Yet, Buffett demonstrably defied this principle. He transformed Berkshire Hathaway from a struggling textile company into a trillion-dollar market capitalization giant, consistently outperforming the market and establishing itself as one of the largest and most respected companies in the United States.

This wasn’t luck. It was the result of a disciplined, rational approach to investing, rooted in deep basic analysis, a long-term outlook, and an unwavering commitment to understanding the businesses he invested in. He didn’t chase trends or rely on complex financial engineering. He simply bought good companies at fair prices,and held them.It’s a strategy that sounds deceptively simple, but requires immense patience, conviction, and the ability to resist the siren song of short-term speculation.

More Than Just Returns: A Model of Principled Leadership

Buffett’s commercial success is undeniable,but what truly sets him apart is how he achieved it. He built Berkshire Hathaway not by seeking personal glory, but by relentlessly focusing on doing what was right for the business and its shareholders. This commitment to ethical conduct, transparency, and long-term value creation fostered a culture of trust and loyalty that is rare in the corporate world.

He understood that building a sustainable business requires more than just maximizing profits. it requires treating employees with respect, fostering strong relationships with customers, and contributing positively to the communities in which Berkshire operates. this holistic approach to business, prioritizing integrity over immediate gains, is a lesson that resonates far beyond the realm of finance.

The Impact of His “Quiet” Departure

Buffett has announced he’s “going quiet,” ceasing his annual shareholder letters and public appearances. This decision, coupled with his accelerated estate planning and philanthropic endeavors, signals a clear transition. While he will remain Chairman, the absence of his insightful commentary and calming presence will be keenly felt.

For many,myself included,Buffett’s voice represented a much-needed dose of rationality in a world often consumed by market noise and emotional reactions. He had a unique ability to cut through the complexity and place events in their proper context, offering a perspective grounded in decades of experience and a deep understanding of economic principles. His retirement marks the waning of that consistent, reassuring voice.

A legacy That will Endure

New generations of investors will undoubtedly emerge,some achieving fleeting success,others building lasting legacies. But Buffett’s impact is unique. He wasn’t just a brilliant investor; he was a teacher, a philosopher, and a role model. He demonstrated that success doesn’t require sacrificing integrity, that wealth can be used for good, and that a simple, disciplined approach can yield extraordinary results.

In an era increasingly defined by short-termism and a relentless pursuit of profit, buffett’s example is more relevant than ever. He reminded us that just because you can do something doesn’t mean you should. He championed philanthropy, encouraged responsible corporate citizenship, and lived a remarkably grounded life, even as he amassed immense wealth.

We are all fortunate to have lived through the age of Warren Buffett. His wisdom, his example, and his unwavering commitment to doing the right thing will continue to inspire investors, business leaders, and individuals for generations to come. His legacy isn’t just about the billions he created; it’s about the values he embodied and the enduring principles he championed. and that, truly

![Sudan Ceasefire: UN Efforts to Renew Peace Deal | [Current Year] Update Sudan Ceasefire: UN Efforts to Renew Peace Deal | [Current Year] Update](https://i0.wp.com/global.unitednations.entermediadb.net/assets/mediadb/services/module/asset/downloads/preset/Collections/Production%20Library/26-01-2025-UNICEF-Sudan.jpeg/image770x420cropped.jpg?resize=330%2C220&ssl=1)

![Sudan Ceasefire: UN Efforts to Renew Peace Deal | [Current Year] Update Sudan Ceasefire: UN Efforts to Renew Peace Deal | [Current Year] Update](https://i0.wp.com/global.unitednations.entermediadb.net/assets/mediadb/services/module/asset/downloads/preset/Collections/Production%20Library/26-01-2025-UNICEF-Sudan.jpeg/image770x420cropped.jpg?resize=150%2C100&ssl=1)