Millions Face Coverage Loss as ACA Subsidies Expire: New Survey Reveals Impact

The future of affordable health coverage hangs in the balance as enhanced Affordable Care Act (ACA) Marketplace subsidies are set to expire. A recent KFF survey, conducted during the initial weeks of open enrollment in November, paints a stark picture of the potential consequences for millions of Americans. The findings reveal that even modest premium increases could force a critically important number of enrollees to forgo coverage or significantly alter their healthcare choices.

The Looming Premium Hike

Approximately 22 million of the 24 million individuals currently enrolled in ACA Marketplace plans benefit from these expiring tax credits. Without their extension, premiums are projected to more than double on average, jumping from $888 to $1,904 annually - a staggering 114% increase. This dramatic rise is already causing concern among enrollees as they navigate their options for 2026.

How Enrollees Would Respond to Doubled Premiums

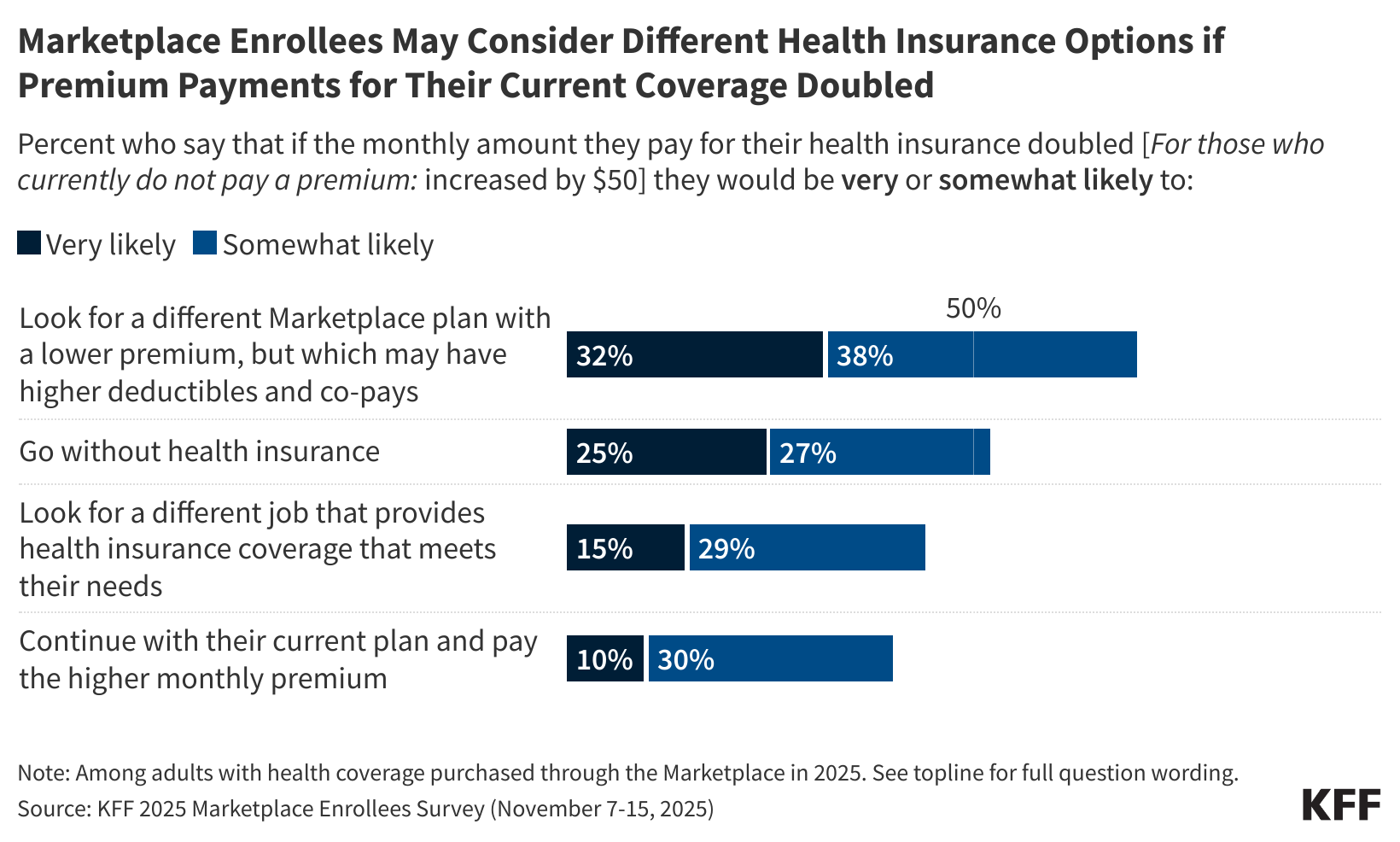

The survey directly asked enrollees about their likely reactions if their monthly premiums where to double.The results are alarming:

* 33% would “very likely” seek a lower-premium marketplace plan, even if it meant accepting higher deductibles and co-pays.

* 25% would “very likely” go without health insurance altogether next year.

These figures underscore the precarious financial position of many Marketplace enrollees. Nearly 60% stated they couldn’t afford a $300 annual premium increase without significantly impacting their household finances, and 20% would struggle with a $1,000 increase.

Beyond Premiums: The Ripple Effect of Rising Healthcare Costs

The financial strain extends beyond just monthly premiums. If total healthcare costs – including premiums,deductibles,and co-pays – were to increase by $1,000 annually,enrollees reported they would likely:

* 67% cut back on essential daily household expenses.

* 54% seek additional employment or work extra hours.

* 41% delay or skip paying othre bills.

* 34% resort to taking out loans or increasing credit card debt.

A Critical Juncture for Healthcare Access

“The poll shows the range of problems Marketplace enrollees will face if the enhanced tax credits are not extended in some form,” explains KFF President and CEO Drew Altman. “These struggles will undoubtedly become a central issue in the upcoming midterms if a bipartisan solution isn’t reached.”

Open Enrollment: Key dates to Remember

Open enrollment for 2026 coverage began on November 1st and continues through January 15th in moast states. However,consumers who want their coverage to begin on January 1st must enroll by December 15th.The majority of enrollees (89%) anticipate making a decision by year-end,with many already having resolute their coverage plans.

image of KFF chart showing enrollee responses to potential premium increases

What This Means for You

The expiration of these crucial subsidies represents a significant challenge to maintaining affordable healthcare access for millions. If you currently receive financial assistance through the ACA Marketplace, it’s vital to carefully review your options during open enrollment and understand how the changes may impact your coverage and costs. Explore all available plans and consider your budget and healthcare needs when making your decision.

Resources:

* KFF: ACA Marketplace Premium Payments Would More Than Double

* Healthcare.gov: Open Enrollment