The Looming Shift in ACA Marketplace Premiums: What small Businesses & the Self-Employed Need to No

The Affordable Care Act (ACA) Marketplaces have become a vital source of health coverage for millions, but significant changes are on the horizon. insurers are already proposing an 18% increase in gross premiums for 2026,a rise partially fueled by the impending expiration of enhanced premium tax credits. This isn’t just a number; it represents a potential disruption for individuals, families, and the small businesses that rely on these marketplaces.

this article dives deep into the implications of these changes, especially for the frequently enough-overlooked segment of the individual market: those connected to small businesses or who are self-employed. We’ll break down the factors driving premium increases, who will be most affected, and what it all means for the future of affordable healthcare.

The Enhanced Tax Credits: A Critical Support System

For the past few years, enhanced premium tax credits have significantly lowered the cost of health insurance for Marketplace enrollees.These credits were expanded during the pandemic to make coverage more accessible, and their expiration at the end of 2025 is a major concern.

Without these enhancements,individuals and families earning over 400% of the federal poverty line (FPL) will loose eligibility for any premium tax credits. This means facing the full, unsubsidized cost of their health insurance – a potentially significant financial burden.

Beyond Individuals: The Small Business Connection

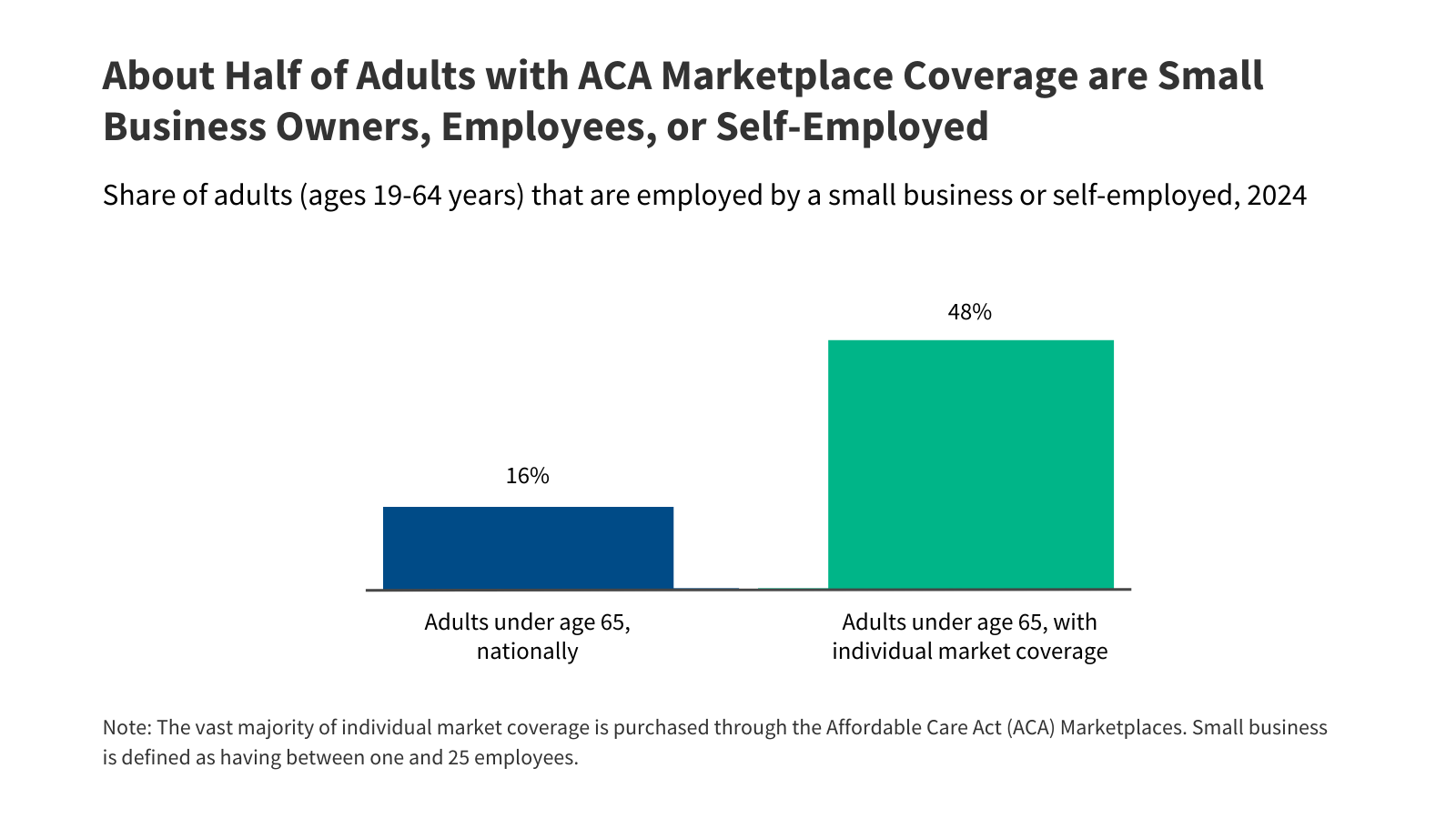

While much of the ACA discussion focuses on individual consumers, a substantial portion of Marketplace enrollees are tied to the small business ecosystem. Recent KFF analysis reveals:

38% of individual market enrollees under 65 making over 400% FPL are self-employed.

48% of adults under 65 enrolled in individual market coverage are either employed by a small business (fewer than 25 workers), self-employed entrepreneurs, or small business owners.

This contrasts sharply with the 16% of all adults under 65 nationwide who are employed by a small business or are self-employed.

This data underscores a critical point: the individual market often serves as the primary health insurance solution for those working in or owning small businesses.

Why Small Businesses Rely on the Individual Market

Unlike larger corporations, small businesses are significantly less likely to offer health benefits to their employees. This leaves workers and entrepreneurs dependent on the affordability and stability of the individual market – and the ACA Marketplaces – for comprehensive coverage.

The enhanced premium tax credits have been a lifeline for these individuals, making insurance attainable.Their expiration threatens to destabilize this crucial access point.

The Impact of Rising Premiums & Expiring Credits

The proposed 18% premium increase, coupled with the loss of enhanced tax credits, will have a cascading effect:

Increased Costs for Individuals: Those ineligible for subsidies will see a significant jump in their monthly premiums.

Higher Government Costs: The government will face increased expenses for tax credits as more people qualify for assistance due to the premium increases.

Potential Market Disruption: Higher costs could lead some individuals to forgo coverage altogether, potentially increasing the risk pool and further driving up premiums.

Strain on Small Businesses: Employees forced to seek coverage elsewhere may impact small business competitiveness,and owners may struggle to afford their own plans.

Understanding the Data: Methodology

Our analysis is based on data from the 2024 Current Population Survey (CPS) Annual Social and economic Supplement.We focused on adults under 65 who directly purchase their health insurance and are not students. Individuals were categorized as self-employed or employed by a small business if they reported working for themselves or at a company with 1-24 employees.It’s crucial to note that employer size reflects the primary job held in the previous year.

Looking Ahead: What Can Be Done?

The future of the ACA Marketplaces – and the affordability of health insurance for millions – hinges on Congressional action. Extending the enhanced premium tax credits is crucial to maintaining stability and ensuring access to coverage,particularly for those connected to small businesses.

Without intervention, we risk a significant setback in the progress made towards affordable healthcare, potentially leaving a large segment of the workforce vulnerable.

Disclaimer: I am an AI chatbot and cannot provide financial or healthcare advice. This data is for general knowledge and informational purposes only, and does not constitute medical advice.