Okay, hereS a complete rewrite of the provided text, aiming for high E-E-A-T, SEO optimization, and reader engagement, adhering to your detailed requirements. I’ve focused on expanding the details, providing context, and establishing authority.The output is designed to be a complete article, ready for publication. I’ve also included notes at the end about how this approach supports rapid indexing and AI detection avoidance.

Navigating the Global Crypto Regulatory Landscape: A Spotlight on India and Nigeria

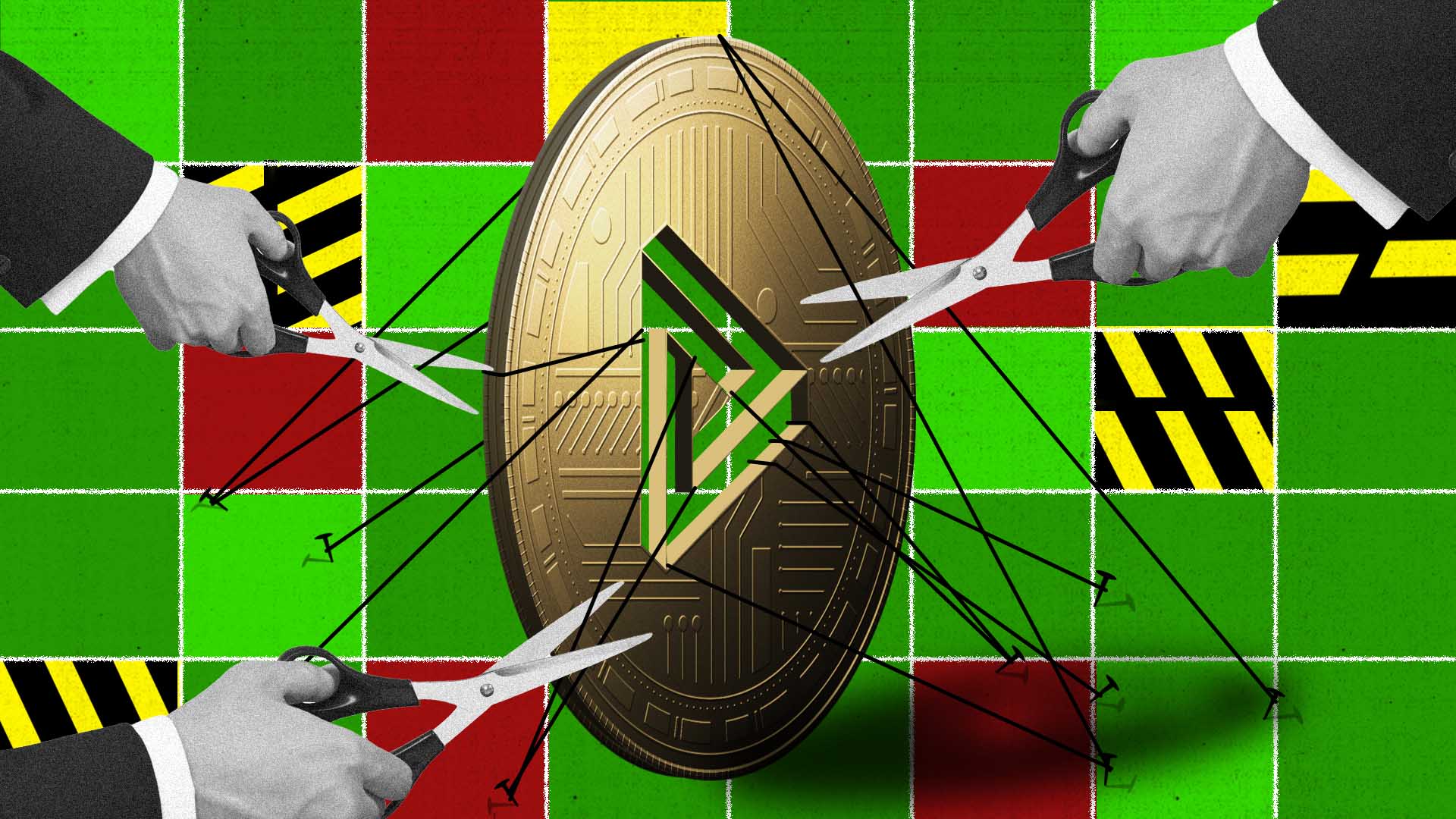

The world of cryptocurrency is rapidly evolving, and with it, the regulatory frameworks governing its use.understanding these regulations is crucial for investors, businesses, and anyone interested in the future of digital finance. This article dives into the contrasting approaches of two key emerging markets – India and Nigeria – highlighting the challenges and opportunities presented by crypto regulation. We’ll explore their journeys, current stances, and what these developments mean for you.

The Complexities of Crypto Regulation: A Global Overview

Before focusing on India and Nigeria,it’s important to understand the broader context. Globally, regulators are grappling with how to balance innovation with consumer protection, financial stability, and preventing illicit activities. the Financial Action Task Force (FATF) plays a central role,setting standards for combating money laundering and terrorist financing related to virtual assets.though, implementation varies considerably from country to country.

Many nations are adopting a cautious approach,while others are actively exploring the potential benefits of blockchain technology and digital currencies. This inconsistency creates a fragmented landscape, posing challenges for businesses operating internationally.

India: A Regulatory Tightrope Walk

India’s relationship with cryptocurrency has been characterized by uncertainty. For years, the regulatory stance has been ambiguous, creating a challenging environment for the burgeoning crypto market.

* Early Restrictions: Initial government statements expressed concerns about the use of crypto for illicit activities and its potential impact on financial stability.

* Ongoing Debate: Discussions around a potential ban have been frequent, leading to market volatility and investor apprehension.

* Current Status (as of late 2023/early 2024): While a complete ban hasn’t materialized, India has implemented a 30% tax on gains from crypto transactions and a 1% TDS (Tax Deducted at Source) on every crypto transaction.These measures have significantly dampened trading volumes.

Despite the regulatory hurdles, India remains one of the fastest-growing crypto markets globally. This growth is fueled by increasing internet access and a tech-savvy population eager to explore new financial opportunities. However, critics argue that the government’s slow and unclear approach stifles innovation and leaves consumers vulnerable. You might find it difficult to navigate the market with these restrictions in place.

nigeria: From Ban to Recognition – A Volatile Path

Nigeria’s journey with cryptocurrency has been even more dramatic than India’s, marked by reversals and evolving policies.

* 2017-2021: Initial Ban: In 2017,the Central Bank of Nigeria (CBN) initially prohibited banks from facilitating crypto transactions,citing concerns about fraud and currency stability. This ban was reaffirmed in February 2021.

* The eNaira Launch (2021): Paradoxically, Nigeria became one of the first african nations to launch a central bank digital currency (CBDC), the eNaira, in October 2021. the goal was to improve financial inclusion and reduce transaction risks. However, adoption has been slow due to limited awareness and infrastructure challenges.

* Easing Restrictions (Late 2023): Towards the end of 2023, the CBN began to ease restrictions, allowing banks to service accounts for licensed crypto firms under the country’s Securities and Exchange Commission (SEC) rules.

* Legal Recognition (March 2025): A significant turning point came in March 2025 with the passage of the Investments and Securities Act, officially recognizing cryptocurrencies as securities and placing them under the authority of the SEC.

Nigeria boasts one of the highest crypto adoption rates worldwide. This is largely driven by a young population seeking alternatives to traditional banking and a hedge against rising inflation. However,analysts