Apple Stock Soars on Siri AI expectations: A Deep Dive into Evercore‘s $325 price Target

Is Apple poised for another surge? Investment firm Evercore recently boosted its price target for Apple (AAPL) to $325,fueled by growing optimism surrounding a significant overhaul of Siri,expected in Spring 2026. This isn’t a sudden shift; Evercore has consistently raised its target since September, reflecting increasing confidence in Apple’s future performance. Let’s unpack the details, explore the driving forces, and assess what this means for investors and Apple enthusiasts alike.

The Upward Trajectory: evercore’s Price Target History

Evercore’s bullish outlook on Apple has been steadily strengthening throughout late 2025. Here’s a timeline of their price target increases:

* September 9th: Initial increase from $250 to $260, driven by anticipated strength in the iPhone 17 lineup.

* Late September: Further upgrade to $290, with a focus shifting towards the performance of the standard iPhone 17 models.

* december 7th: the latest and most significant jump to $325, directly linked to heightened expectations for Apple’s advancements in Artificial Intelligence, notably Siri.

The Siri Factor: Why the AI Assistant Matters

The core of Evercore’s optimism lies in the anticipated transformation of Siri. For years, Apple’s voice assistant has lagged behind competitors like Google Assistant and Amazon’s Alexa in terms of functionality and natural language processing. Though, Apple is heavily investing in AI and machine learning, and a revamped Siri is expected to be a key differentiator.

What could this improved Siri look like? Experts predict:

* Enhanced Natural Language Understanding: A Siri that can better understand complex requests and nuanced language.

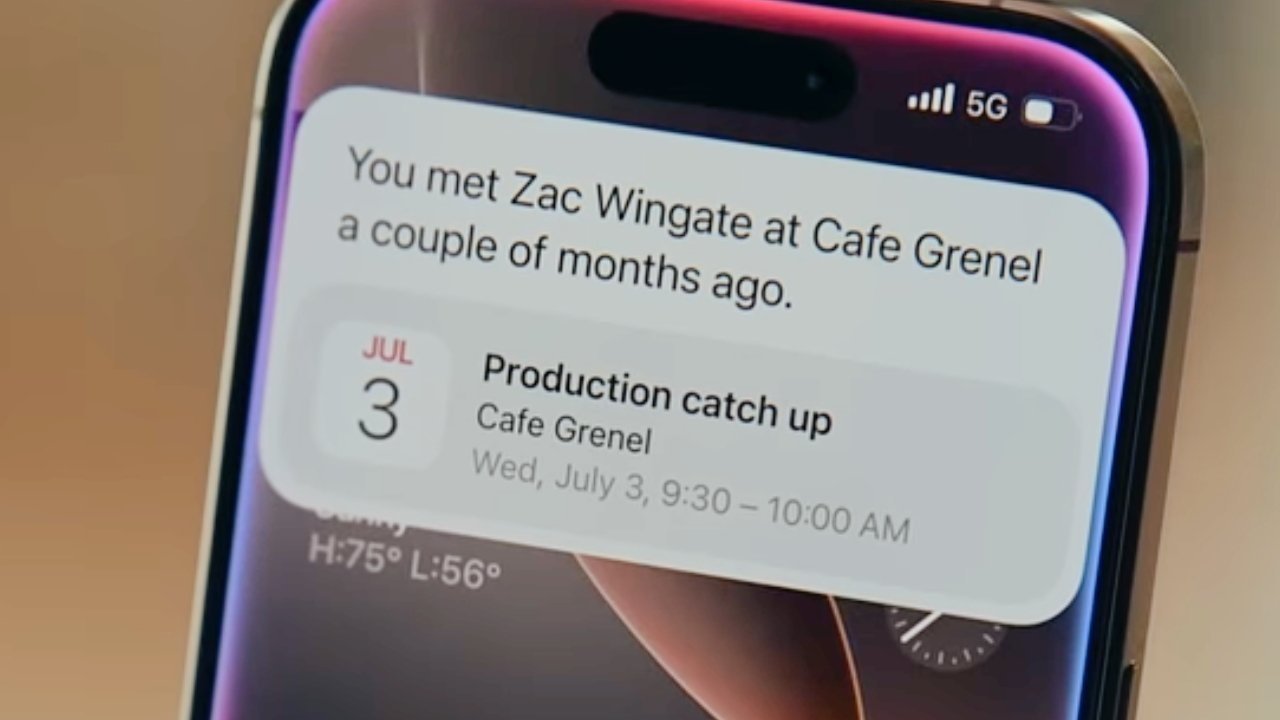

* Proactive Assistance: Moving beyond reactive responses to anticipate user needs.

* Seamless Integration: Deeper integration with Apple’s ecosystem of devices and services.

* Generative AI Capabilities: Leveraging large language models (LLMs) for more creative and informative interactions.

Beyond Siri: Other growth Drivers for Apple

While Siri is a major catalyst, it’s not the only factor driving Evercore’s positive outlook. The firm also acknowledges the continued strength of Apple’s core products, particularly the iPhone.

Here’s a breakdown of additional contributing factors:

* iPhone 17 Pro Max Demand: strong pre-order numbers and initial sales data suggest robust demand for the premium iPhone 17 models.

* Potential of the iPhone Air: While initially less emphasized, the potential of a more affordable iPhone Air to expand Apple’s market share is being recognized.

* Wearables and Services Growth: Continued expansion of apple’s wearables (Apple Watch, AirPods) and services (apple Music, Apple TV+, iCloud) businesses.

* Vision Pro Ecosystem: The long-term potential of Apple’s spatial computing platform, Vision Pro, and its associated ecosystem.

Apple’s Growth Drivers: A Rapid Comparison

| Feature | iPhone 17 | Siri (Revamped) | Services | Vision Pro |

|---|---|---|---|---|

| Impact | Core Revenue | Potential for New Revenue Streams & user Engagement | Recurring Revenue | Long-term Growth |

| Timeline | Now – 2026 | Spring 2026 | Ongoing | 2026 Onward |

| Key Benefit | Market Share,Brand loyalty | Enhanced User Experience,competitive Advantage | Increased Profitability | Innovation,New Market |

![EUDA & QB Token: Boosting the Digital Health Ecosystem | [Year] Update EUDA & QB Token: Boosting the Digital Health Ecosystem | [Year] Update](https://i0.wp.com/www.hospitalmanagement.net/wp-content/uploads/sites/9/2025/12/Hospital-5-23-12-2025-shutterstock_2284890973.jpg?resize=150%2C100&ssl=1)