Navigating Shifting Economic Tides and Corporate Values: A September 2025 Update

The economic landscape experienced a notable shift today, September 18, 2025, as the United States Federal Reserve implemented a reduction in interest rates. Concurrently, a critically important progress unfolded within the corporate world, highlighting the growing tension between brand activism and parent company objectives. This article delves into both events,providing a complete analysis of their implications and offering insights into the broader trends shaping the current economic and business climate. The primary focus will be on interest rate adjustments, exploring their potential impact on consumers and businesses.

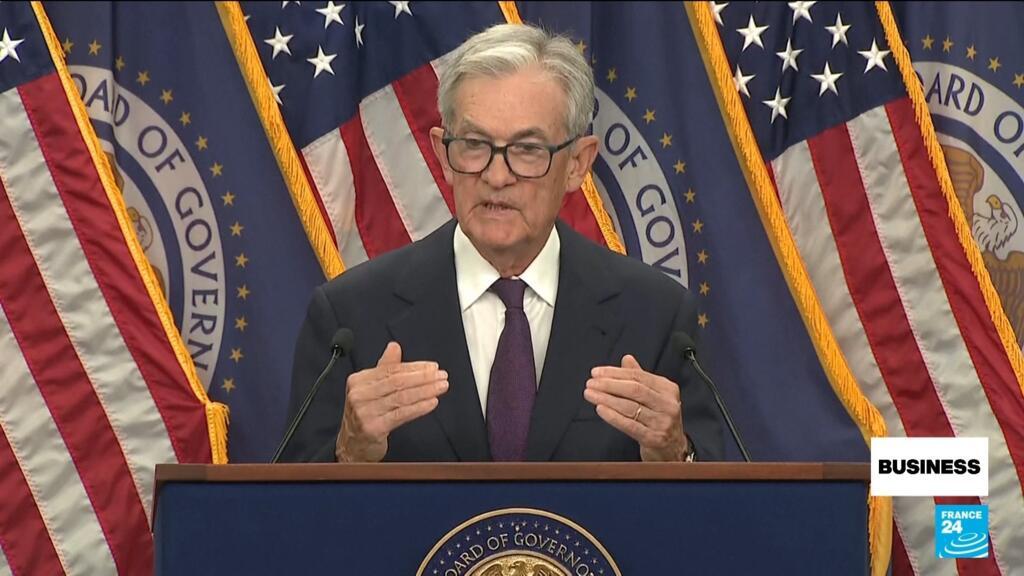

Federal Reserve Rate Cut: A Response to Economic Headwinds

In a move anticipated by many market analysts, the federal Reserve announced a 0.25% decrease in its benchmark interest rate, establishing a new target range of 4.00% to 4.25%. This decision, made by the Federal Open Market Committee (FOMC), reflects a cautious approach to managing economic growth amidst increasing global uncertainties. According to recent data released by the Bureau of Economic Analysis on September 15, 2025, the U.S. GDP growth slowed to 2.1% in the second quarter, prompting the Fed to act proactively.

| Metric | Previous Value (June 2025) | Current Value (September 2025) |

|---|---|---|

| Federal Funds Rate | 4.25% – 4.50% | 4.00% – 4.25% |

| U.S. GDP Growth (Q2) | 2.4% | 2.1% |

| Inflation Rate (August 2025) | 3.5% | 3.2% |

The vast majority of the FOMC – eleven out of twelve members – supported the rate reduction. however, a dissenting voice emerged from Stephen Miran, a recent appointee to the board and a known ally of the current presidential administration. This divergence in opinion underscores the political complexities influencing monetary policy decisions. Miran’s opposition, while notable, did not prevent the implementation of the rate cut, signaling a consensus view within the committee regarding the need for economic stimulus.

did You Know? The Federal Reserve’s dual mandate is to promote maximum employment and stable prices. Rate adjustments are a primary tool used to achieve these goals.

From a practical standpoint, this rate decrease is expected to translate into lower borrowing costs for consumers and businesses. Mortgage rates, auto loan rates, and credit card interest rates are all likely to decline, potentially stimulating spending and investment. However, the impact may be tempered by ongoing global economic challenges, including geopolitical tensions and supply chain disruptions. As a financial advisor, I’ve observed that while lower rates are generally positive, they can also erode savings yields, requiring individuals to reassess their investment strategies.

Ben & Jerry’s Activism and Corporate Control: A Case Study in Brand Values

Parallel to the Fed’s announcement, a significant event unfolded within the consumer goods sector. Jerry Greenfield, the co-founder of the iconic ice cream brand Ben & Jerry’s, publicly resigned from the company, citing concerns over its parent company, Unilever‘s, alleged suppression of the brand’s social activism. Greenfield accused Unilever of prioritizing profits over principles,specifically referencing restrictions placed on Ben & jerry’s advocacy related to the Israeli-palestinian conflict.

Unilever has consistently undermined our social mission, prioritizing financial gain over our commitment to justice and equity.

This situation highlights a growing trend: the increasing scrutiny of corporate social obligation (CSR) and the challenges faced by brands attempting to balance activism with the demands of their parent companies. Ben & Jerry’s has long been known for its progressive stances on social and political issues, a key element of its brand identity.However, Unilever, a multinational corporation with broader stakeholder interests, appears to have taken a more cautious approach.