Navigating the Private Equity Landscape: Beyond the Hype to lasting Value

The world of private equity can feel like a high-stakes game. Fortunes are made and lost, often based on more than just sound business principles. As a veteran of this industry, I’ve seen firsthand how crucial it is to understand who you’re partnering with, not just what the pitch deck promises. This article will equip you with the insights to navigate this complex landscape, avoid costly pitfalls, and identify the investors who can truly unlock your company’s potential.

The Two Sides of the Coin: Investor Archetypes

We often see a clear divide in the private equity world. On one side, you have the large, generalist investors. they often rely on quick assessments and broad market trends.On the other, are the niche specialists – those who deeply understand the intricacies of specific sectors.

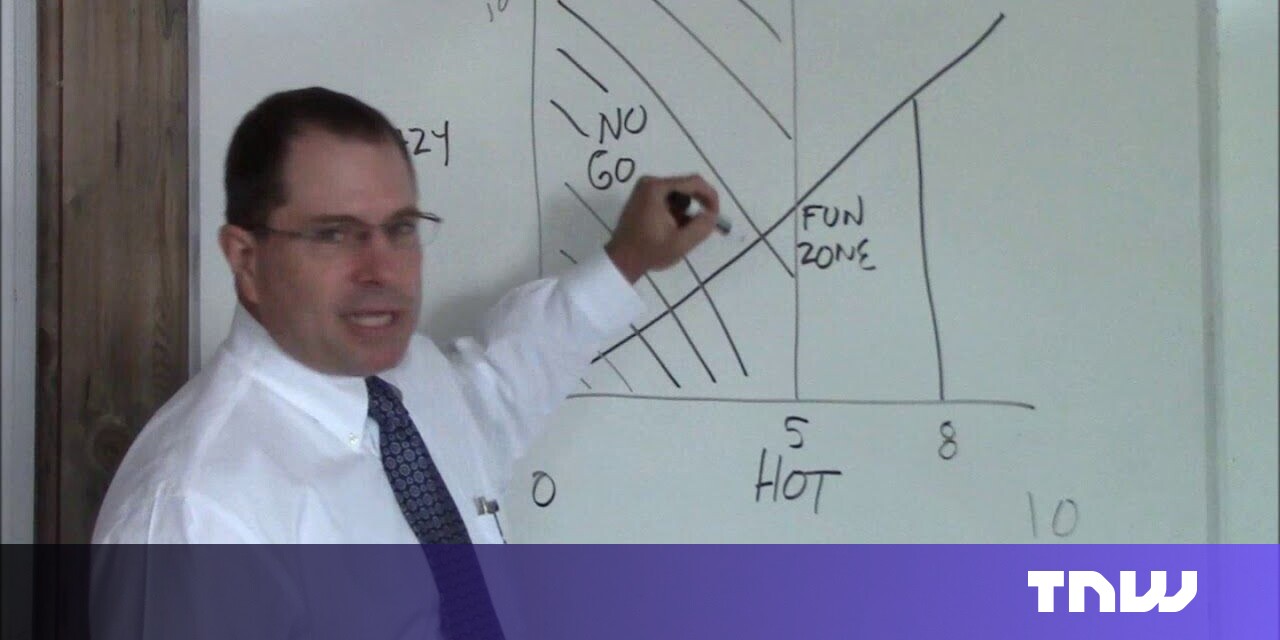

think of it as a matrix. The goal? To land in the ”sweet spot” – a partnership that combines both financial strength and genuine expertise.

Why “Deep Pockets“ Aren’t Always Enough: The Danger Zone

The biggest risk lies with those large, generic funds. They possess substantial capital, but frequently enough lack the granular understanding needed to properly evaluate an investment. This isn’t strategic investing; it’s speculation. While it might feel good in the short term, it’s a recipe for disaster.

These investors often struggle to effectively interrogate details, leaving critical flaws hidden beneath a glossy exterior. Don’t be surprised if you end up losing notable value.

Exhibit A: The Builder.ai Cautionary Tale

The collapse of Builder.ai serves as a stark warning. Investors, including major players like Microsoft and Qatar’s Sovereign Wealth Fund, injected over $450 million into the company, valuing it at over $1 billion.

However,a closer look revealed significant issues. Revenue figures were inflated by 300%, and the “AI-powered” platform relied heavily on manual labor. This oversight, stemming from a lack of deep due diligence, proved incredibly costly. You can read more about it here. This exemplifies how deep pockets without deep understanding can lead to expensive missteps.

The Value of Niche Expertise – But It’s Not Always Enough

Niche specialists, on the other hand, do possess the knowledge. They understand the nuances of your industry, your product, and your competitive landscape. However, these firms are often smaller.

While expertise is vital, a growing business also needs substantial capital to scale. brains are great, but they need brawn to truly move the needle.

Finding the “Marriage Material”: The Ideal Investor Profile

The ideal partner sits in the “sweet spot” – what I call the “marriage zone.” This is a fund large enough to support a full buyout, and informed enough to unlock genuine value within your specific sector.

Consider a capital markets data company, such as. This type of investment thrives on specialized understanding.Here’s what makes this partnership work:

Expertise Drives Investment: A deep understanding of the sector informs strategic decisions.

Investment Builds Expertise: Triumphant investments further refine and expand the fund’s knowledge base.

Long-Term Vision: A commitment to sustainable growth, not just quick returns.

The Mythical Unicorn: The Deeply Specialized Mega-Fund

Does a massive private equity firm with truly deep, specialized expertise exist? Perhaps.But finding one is incredibly rare. It’s akin to finding a partner who is rich, kind, funny, and* can fix your Wi-Fi.

Don’t hold your breath.

Beyond the Pitch Deck: Discernment is Key

In private equity, as in life, appearances can be deceiving. Flashy presentations and inflated valuations are tempting, but they shouldn’t be the deciding factors. You need to look beyond the surface.

When capital is readily available, clarity becomes paramount. Private equity demands more than just enthusiasm – it requires careful discernment.

The Hot Crazy Matrix & A Lasting Lesson

The popular “Hot Crazy Matrix” meme offers a surprisingly relevant lesson. The smartest investors aren’t chasing