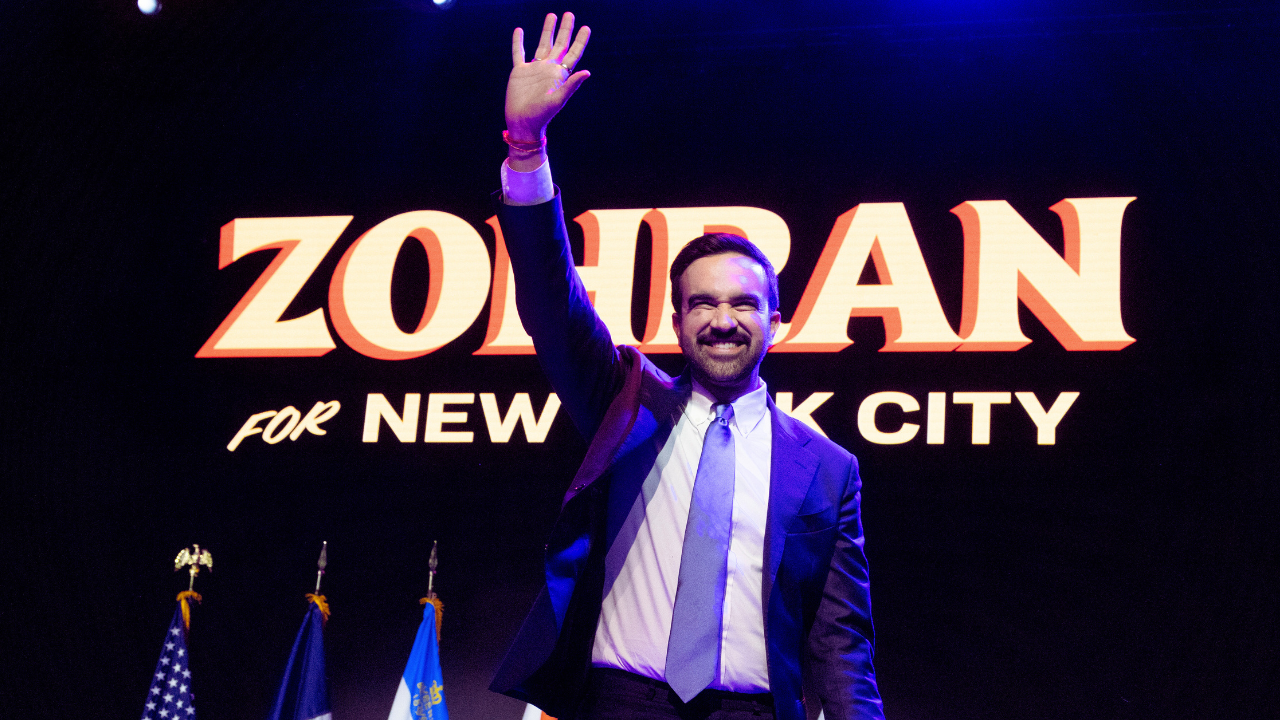

New York City Mayoral Candidate Proposes Bold Tax Plan to Fund Enterprising Agenda

A prominent New York City mayoral candidate is generating significant discussion with a proposal to reshape the city’s financial landscape. He’s advocating for increased taxes on both corporations and the wealthiest residents to fuel a sweeping economic agenda. Let’s delve into the details of this plan and the potential challenges it faces.

The Core of the Proposal

The candidate’s “revenue plan” centers around two key components. First, he proposes raising the corporate tax rate to 11.5%, aligning New York with neighboring New jersey. This move is projected to generate an additional $5 billion in revenue.

Secondly, he aims to implement a flat 2% tax on New Yorkers earning over $1 million annually. This would specifically target the top 1% of income earners in the state.

Funding Priorities and Potential Impact

Thes increased revenues would be directed towards funding a range of programs designed to address key issues facing New York City. While specific details are still emerging, the candidate has indicated a focus on bolstering social services and investing in infrastructure.

You might be wondering how realistic these projections are. The candidate’s team has publicly shared their detailed calculations, available for review. However, implementing such a plan isn’t as simple as drafting legislation.

Navigating the Political Landscape

Any significant tax changes require approval from the New York state legislature. Furthermore, the governor’s signature is essential for the plan to become law. This introduces a layer of political complexity.

Currently, the governor has expressed reservations about raising taxes. She’s cited concerns that increased taxes could incentivize high-income earners and businesses to relocate, ultimately harming the state’s economy. This opposition presents a ample hurdle for the candidate’s proposal.

concerns and Counterarguments

The idea of increasing taxes on the wealthy often sparks debate. Critics argue that such measures can stifle economic growth and discourage investment. They suggest that a more effective approach involves attracting businesses and fostering a favorable economic climate.

However, proponents contend that a progressive tax system – where higher earners pay a larger percentage of their income in taxes – is a fair way to fund essential public services and address income inequality. They believe that the benefits of these investments outweigh the potential drawbacks.

A Warning from Washington

Adding another layer to the discussion, a recent statement from a Treasury official cautioned against expecting a federal bailout if the city were to face financial difficulties under this new economic model. The message was direct: New York City would need to stand on its own two feet.

What This Means for You

This proposal represents a pivotal moment for New York City.It signals a potential shift in economic policy and a willingness to explore bold solutions to address the city’s challenges. Weather this plan gains traction remains to be seen, but it’s undoubtedly a conversation that will shape the future of the city for years to come.

It’s crucial for you to stay informed about these developments and understand how they might impact your own financial situation and the overall economic health of New York City.