Understanding U.S. Health Care Spending: A Detailed Breakdown

navigating the complexities of U.S. health care spending requires a clear understanding of how expenditures are categorized and tracked. this guide, based on data and definitions from the Kaiser Family Foundation (KFF), provides a comprehensive overview of the major components of national health expenditures (NHE), offering insights into where your health care dollars go and how different sectors contribute to the overall cost.We’ll break down spending by funding source and service category, ensuring a robust and authoritative understanding of this critical topic.

Why is Understanding Health Care Spending Important?

A clear picture of health care spending is vital for policymakers,healthcare professionals,and individuals alike. It informs decisions about resource allocation, policy growth, and personal financial planning. By understanding the nuances of how spending is defined and categorized, we can better analyze trends, identify areas for improvement, and advocate for a more efficient and equitable healthcare system.

How Health Care Spending is Categorized: Funding Sources

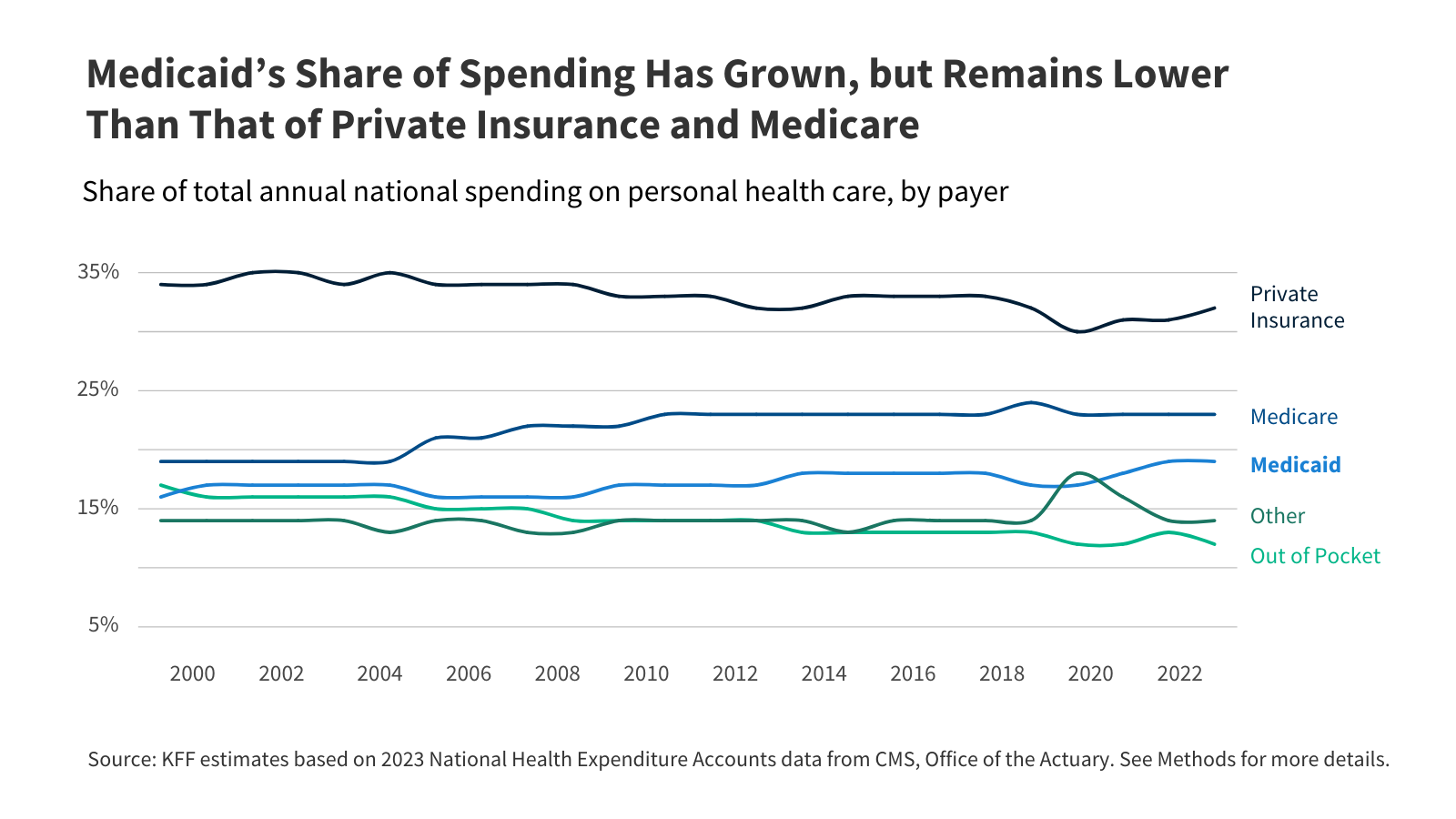

The KFF categorizes health care spending into five primary funding sources: Medicare, Medicaid, Private Insurance, Out-of-Pocket, and “Other.” Here’s a detailed look at each:

1. Medicare: This federal health insurance program primarily covers individuals aged 65 and older, as well as certain younger people with disabilities. Medicare spending encompasses all expenditures related to Part A (hospital insurance), part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage).

Important Note: Spending on Medicare supplemental insurance (like Medigap) and employer-sponsored Medicare part D plans are not included in Medicare spending figures. These are categorized as Private Insurance spending. This distinction is crucial for accurate analysis.

2. Medicaid: A joint federal and state program, Medicaid provides health coverage to low-income individuals and families.Medicaid spending includes all expenditures related to covered services for eligible beneficiaries.

3. Private Insurance: This broad category encompasses a wide range of health coverage options, including:

Fully-Insured Plans: Traditional health insurance purchased individually or through employers.

Self-Insured Employer Plans: Employer-sponsored plans where the employer assumes financial risk for healthcare costs.

Affordable Care Act (ACA) marketplace Plans: Insurance purchased through the Health Insurance Marketplaces established by the ACA.

Indemnity Plans: Plans covering specific services like hospital care or long-term care.

Supplemental Medicare Plans (Medigap): Policies designed to cover gaps in Medicare coverage. Crucially, these are categorized under Private Insurance, not Medicare.

4. Out-of-Pocket: This represents direct consumer spending on healthcare, including:

Coinsurance: The percentage of healthcare costs a patient pays after meeting their deductible. Deductibles: The amount a patient pays before insurance coverage begins.

Other Uncovered Costs: Any healthcare expenses not covered by insurance.

Important Note: Premiums paid for insurance plans are not included in out-of-pocket spending; thay are categorized under the relevant insurance type (Private Insurance or Medicare).5. Other: This category encompasses a diverse range of public and private health care expenditures, including:

Children’s Health Insurance Program (CHIP): Provides low-cost health coverage to children in families who earn too much to qualify for Medicaid.

indian Health Services (IHS): Provides health services to American Indians and Alaska Natives.

Substance Abuse and Mental Health Services Administration (SAMHSA): Funds programs related to mental health and substance use disorders.

Veterans Health Administration (VHA): Provides healthcare services to veterans.

Federal Spending on PCIP & COVID-19 Relief: Expenditures through programs like the Pre-Existing Condition Insurance Plan (PCIP) and COVID-19 relief funds (e.g., the Provider Relief Fund).

state and Local Programs: Includes programs like temporary disability insurance and provider subsidies.

Direct Payments to Needy Individuals: Programs like State Pharmaceutical Assistance Programs.

Property or Casualty Insurance: coverage for health-related expenses not typically covered by traditional health insurance.

Spending by Service Category: Where the Money Goes

Beyond funding sources, understanding how healthcare dollars are spent is equally important. KFF utilizes the National Health Expenditure (NHE) Accounts definitions for key service categories:

1. Hospital Care: This includes all services provided by hospitals, encompassing:

* Inpatient Services: Room and board, resident physician services, inpatient pharmacy, and