Jane Sarasohn-Kahn

2026-01-15 15:36:00

Why was Progresso Soup and its manufacturer General Mills at CES 2026? Specifically, in the AgeTech Collaborative curated by AARP?

If you are part of the health/care ecosystem in any of its segments, chances are you’re attending conferences at the start of 2026 or soon to attend one. I spent last week at CES 2926 in Las Vegas getting updates on digital health, well-being, and self-care innovations. This week, hundreds of my colleagues are attending #JPM2026, the 44th annual J.P. Morgan Healthcare Conference held in San Francisco every year at this time.

One conference that would not have been well-attended by healthcare people is the NRF 2026, the National Retail Federation meet-up that convened 11-13th January at the Javits Center in New York City. This convention is often referred to as “Retail’s Big Show,” not unlike CES’s role as the big show for consumer electronics.

I’m catching up with the food and retail trends and announcements that emerged during NRF 2026 for my research workflows, and want to share my lens on the role of food in health that was quietly but not too assertively addressed at either CES or JPM this year — but it’s a significant factor for health consumers as people look to engage more directly in their own health and that of their families and households. For me, the lens on food is for food-as-medicine and food access as a driver of health (think: food deserts, SNAP program updates, food security, and other challenges many health citizens face in their personal health ecosystems).

And right now, it’s all about protein. Which helps us answer the question, “Why was Progressor Soup at CES?”

It’s the protein story that the soup brand evangelized as part of the AgeTech Collab with AARP, bolstering the importance of nutrition for longevity and healthy aging.

Many food-consumer surveys were published in the past couple of weeks – as part of the perennial New Year’s Resolution press release opportunity, and as part of the larger healthy living phenomenon bolstered by the adoption of GLP-1 medicines for weight loss, fitness intentions, and the very difficult choice some families in the U.S. now face in terms of the cost of health insurance and medical care in general.

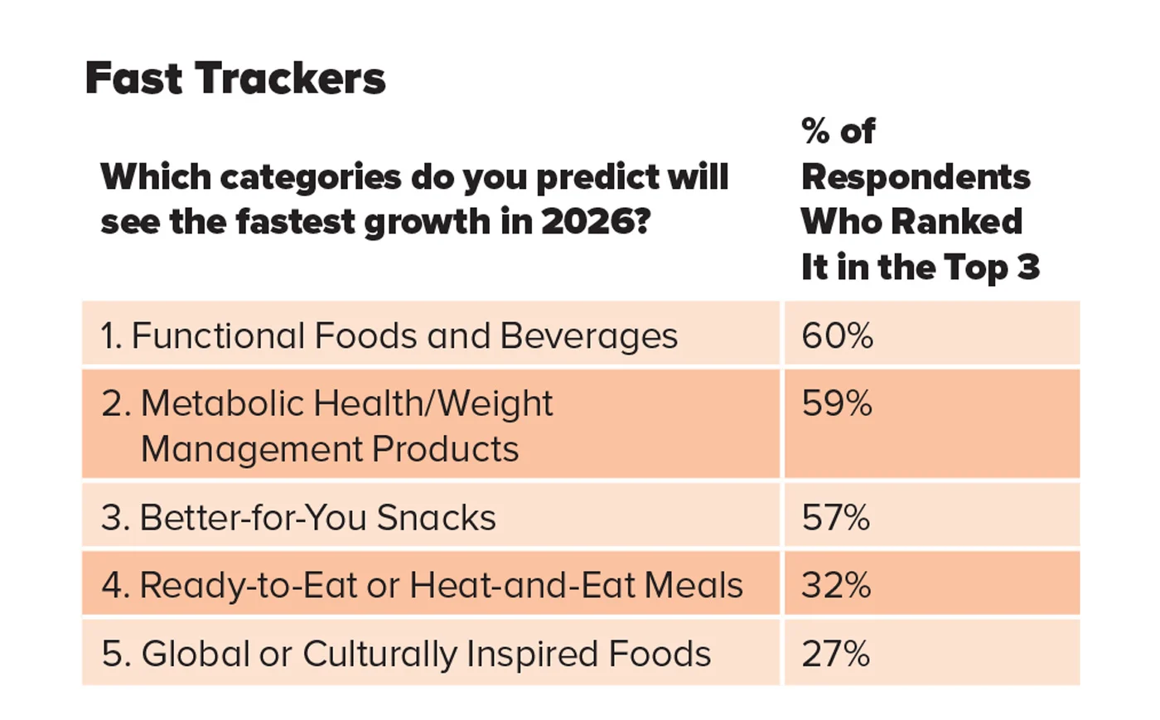

Start with the first chart from The Food Institute study on diet trends to watch in 2026 (spoiler alert: metabolic eating and gut health prioritized by consumers).

See that about 8 in 10 U.S. consumers made health and nutrition a priority in 2026, and the same proportion calling out mental health nutrition and nutrient-rich foods when they are planning meals or shopping at the grocery store.

And so we get to protein, with 2 in 3 Americans saying protein content is important while shopping quantified in The Food Institute research.

See that most U.S. adults rank meat as the primary source of protein — although noted by fewer people who were “passionate about health and fitness.”

Furthermore, 54% cite dairy products as a primary source of protein, albeit that fewer — 48% — of U.S. consumers passionate about health and fitness as keen on dairy.

The passionate health consumers are keener on fish or seafood, nuts and seeds, and protein supplements for protein sources, The Food Institute contrasts.

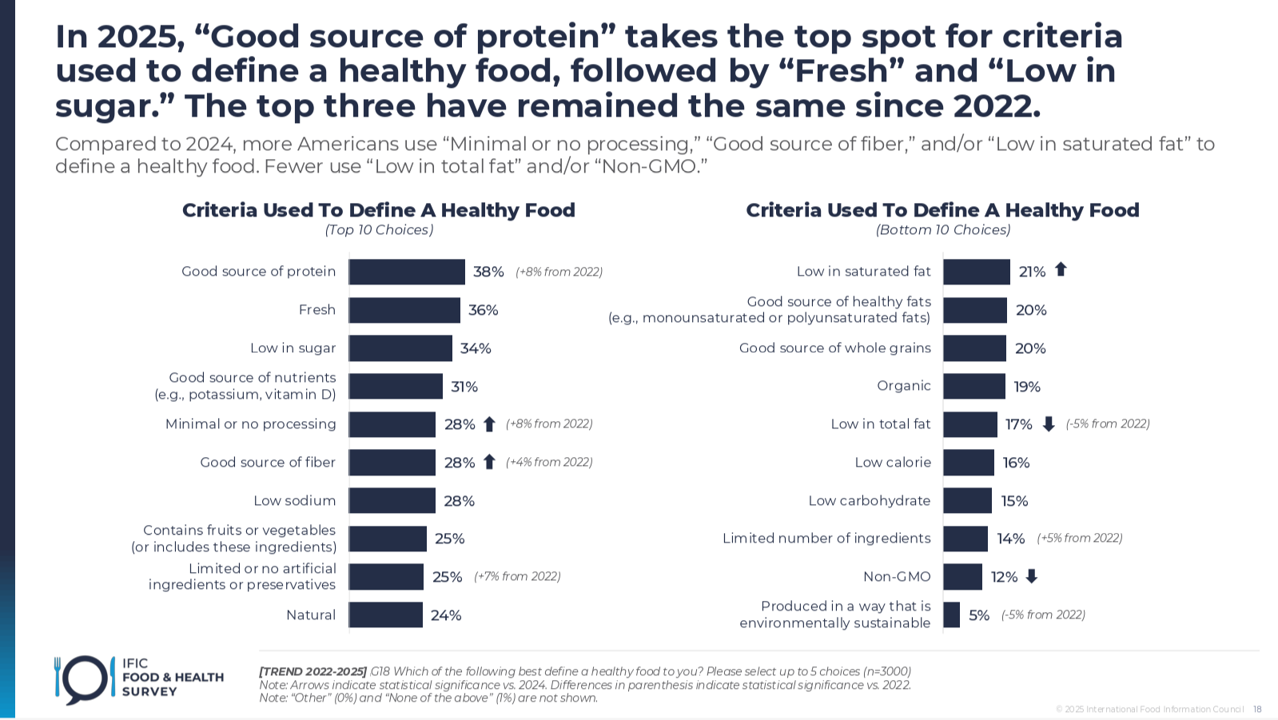

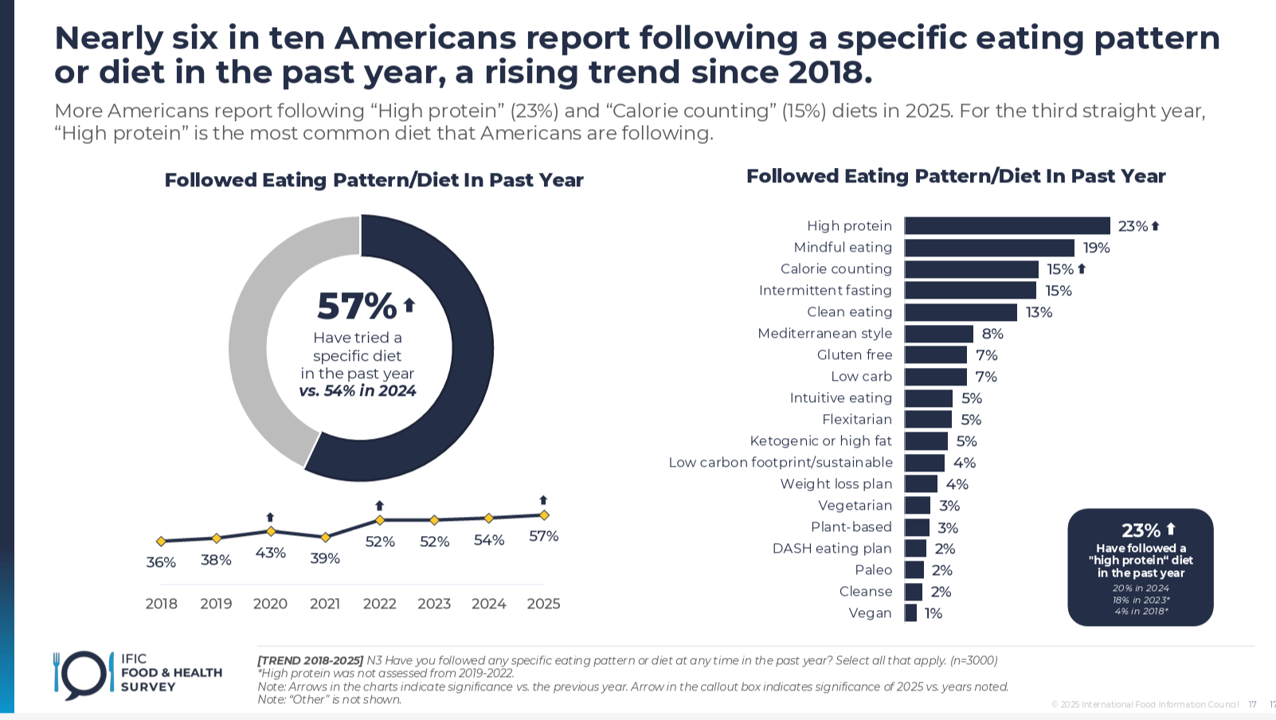

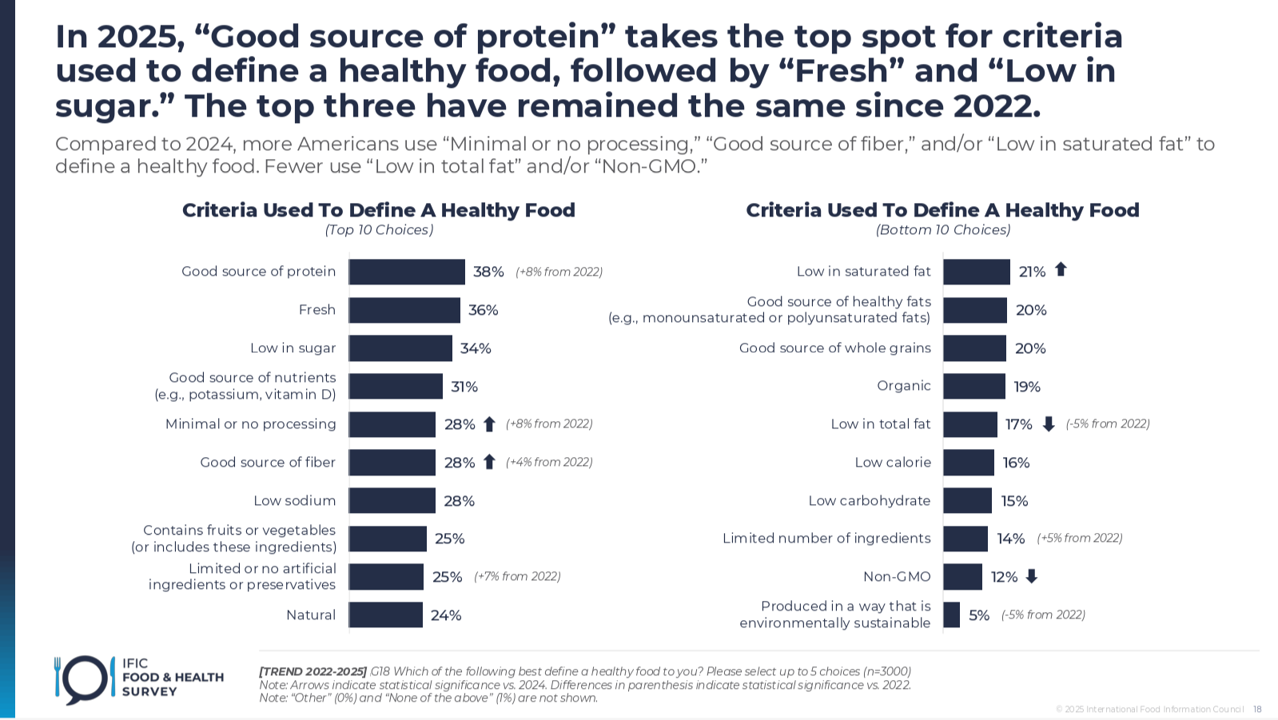

Now check out IFIC’s latest look into Food & Health. The food industry Council found that over one-half of Americans tried a specific eating pattern or diet in the past year (2024-25). Leading the pack was looking for high protein, cited by 1 in 4 people following a specific pattern. After protein was mindful eating, then counting calories, intermittent fasting, and clean eating.

“A good source of protein” was in fact the top-ranked criterion for a “healthy food” in the IFIC study. “Fresh” closely followed protein as a component of “healthy” with being low in sugar, source of nutrients, minimal processing, fiber, and low sodium ranking as healthy criteria among at least 1 in 4 consumers.

More generally beyond protein, consumers are seeking function, weight management, and better-for-you products when shopping for food, according to the just-released study from IFT and Food Technology Magazine on what consumers want in 2026.

“People want to eat their way to feeling better,” explained Arlin Wasserman of Changing Tastes, quoted in the IFT report.

But be aware that affordability and prices will be a consumer priority in balance with health and wellness goals.

We are talking about health “consumers” here, and that means out-of-pocket household spending on food-for-health competes with other household spending on housing, energy, and costs-of-living for families (such as clothing, entertainment, education and so on).

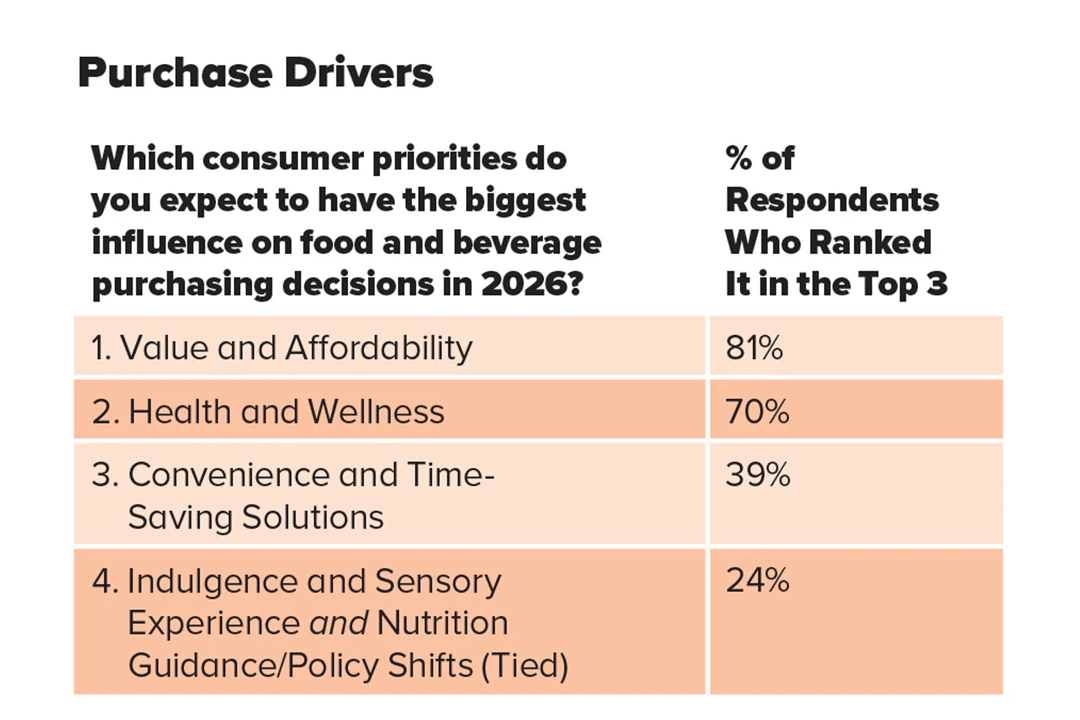

This chart from the IFT survey should be front-of-mind for those of us firmly focused on the role of food (and other self-care and medical spending) in health.

Four in five consumers cite Value and Affordability as the top influence for food and beverage purchasing decisions this year. 7 in 10 note Health and Wellness rank as the biggest influence (multiple choices allowed for Top 3 ranking methodology).

Health Populi’s Hot Points: Two major retail health announcements were made early in this new year that will continue to re-shape the landscape for food-and-health: Walmart is back into health care services with Better Care Services, a virtual care digital “on-ramp” to care driven by consumers; and Target, announcing that it would augment its wellness products by 30% as well as focusing on healthy food, athleisure wear, and other consumer-driven categories of shopping in the store.

Walmart has achieved “everything, everywhere, all-at-once” status, according to the National Retail Federation’s discussion of the Top 10 Trends announced at their meeting earlier this week. Walmart ranked as the most powerful U.S. retailer in Kantar’s 2025 PowerRanking, calling out, “technology, data analytics, and automation [that] have set the standard for operational excellence and shopper relevance, making it the benchmark for the industry,” (Note that Amazon ranked #2 in Kantar’s PowerRankings). I remain hopeful that Walmart can be a leader in health care services as it leverages these technology investments for omnichannel service platforms that can enable health care, everywhere, across many consumer-facing health flows.

On the healthy food front, Walmart also expanded its healthy recipes portal to bolster consumers’ access to nutritious cooking ideas in the home.

Target’s news for health-and-wellness increasing its SKUs for self-care and other categories is building on an existing health-focused shopper: “About 70% of guests are already shopping wellness at Target and right in time for the new year, we’re bringing them even more newness and value by adding some of the most trusted, relevant and inspiring brands across our assortment,” Lisa Roath, executive vice president and chief merchandising officer of food, essentials and beauty at Target was quoted in the company’s press release. “Our goal is to make wellness really accessible – fun, easy, affordable and personalized – so consumers can focus on building routines that help them look and feel their best.”

Interestingly, coming full circle in this post, I add that Target’s press release also talks about “More protein, more ways.” The store’s consumer research knows the data — that more consumers are “boosting protein across their day,” in the company’s words — so they announced protein-product news such as expanding ButcherBox’s grass-fed beef options available in the Target grocery, and more protein-infused snacks and powders via Bloom, David, FlavCity, and Misfits.

As GLP-1s fast-expanded adoption by consumers in 2024-25, some CPG brands were losing money in the snack, candy, and beverage aisles of the grocery store. Now, brands and stores are catching up to capitalize on this fast-evolving consumer and marketplace. For example, Kroger launched a protein-product line as part of its Simple Truth private label, and Big Food companies like Conagra, Danone, and Nestlé are expanding this aspect of their businesses.

As consumers spend more out-of-pocket on health care and become impatient patients, they’ll be looking to engage in friction-less, enchantingly-designed, value-based options for self-care. Food-for-medicine and -function will be a key focus for mainstream consumers.

Just ask Walmart and Target.