Microcredit serves as a vital tool, offering tangible support and simplifying access to an essential service. It’s a targeted response designed to empower families, workers, and businesses facing challenges in securing conventional loans, assisting them with essential expenses or the growth of economic activities. This renewed commitment reflects a belief in the power of microcredit, built on duty and consistent support, ultimately strengthening opportunities and preventing financial exclusion.

This agreement signifies a deliberate policy choice – investing in microcredit as a public instrument for autonomy and accountability. It’s a model that demands commitment and repayment,guiding individuals thru a structured and informed process.A system has been developed that prioritizes financial literacy, guidance, and ongoing mentorship, because true inclusion requires public presence, attentive listening, and consistent support before, during, and after loan access.This initiative addresses diverse and often hidden vulnerabilities: families in need, self-employed workers, young people, women, and aspiring entrepreneurs excluded from conventional lending channels.

This project intercepts diverse and often invisible fragilities: families in difficulty, self-employed workers, young people, women, aspiring entrepreneurs excluded from traditional credit channels.

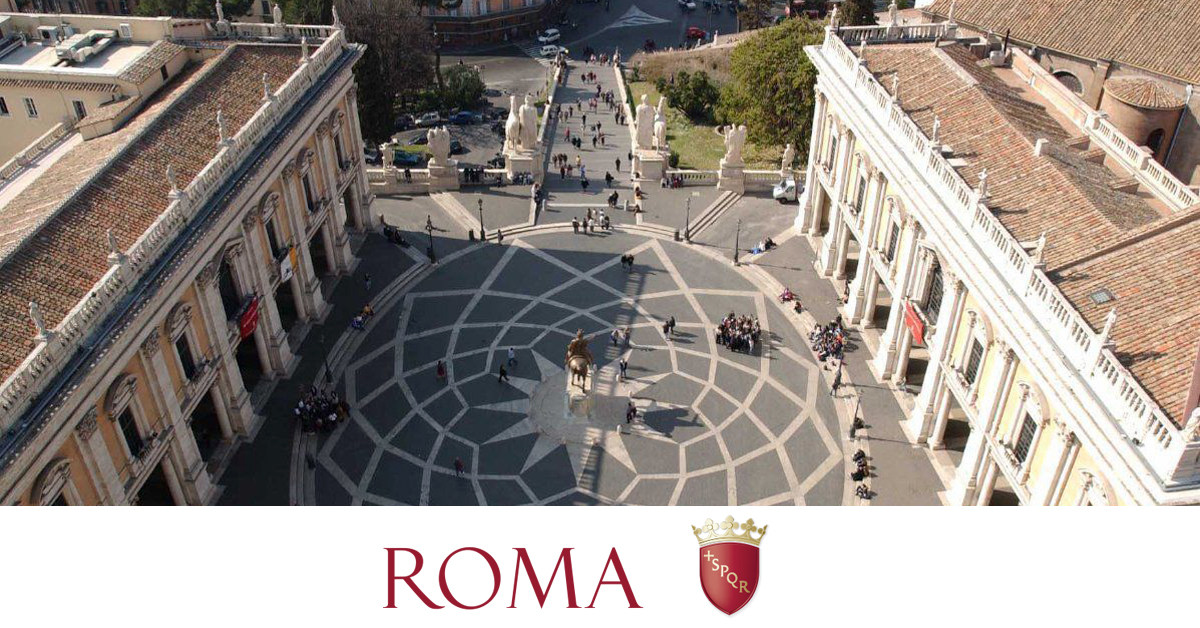

The renewal underscores the central role of the Territorial Office for Microcredit of Rome Capital, operating within the Department of Economic Development and Productive Activities. It functions as a public front office for the administration, providing a reliable and accessible point of contact for guidance and processing applications, in coordination with municipalities and local networks.

By reaffirming this commitment, Rome Capital positions microcredit as a key component of its economic and social policies, choosing a public finance approach focused on impact, dignity, and social inclusion.

Understanding the Power of Microcredit

Microcredit isn’t simply about providing small loans; it’s about fostering financial independence. I’ve found that many individuals and small businesses are overlooked by traditional banks due to a lack of credit history or collateral. Microcredit fills this gap, offering a pathway to economic empowerment. According to a recent report by the World Bank (December 2025), microfinance institutions have a repayment rate of over 90% globally, demonstrating the commitment of borrowers to financial responsibility.

Here’s what works best when considering microcredit:

- Financial Education: Understanding budgeting, saving, and debt management is crucial.

- Business Planning: A solid plan increases your chances of success.

- Repayment Capacity: Honestly assess your ability to repay the loan.

Did you know? Microcredit originated in Bangladesh with the work of Muhammad Yunus, who won the Nobel Peace Prize in 2006 for his pioneering efforts.

Who Benefits from Microcredit?

Microcredit is designed to support a wide range of individuals and businesses. It’s particularly beneficial for those who are traditionally underserved by the financial system. This includes:

- Families facing unexpected expenses.

- Self-employed individuals needing capital to grow their businesses.

- Young entrepreneurs with innovative ideas.

- Women seeking to start or expand their ventures.

Pro Tip: Before applying for microcredit, explore all available resources, including grants and other forms of