Koh Samui Property Market: A Surge in Demand Fuels Growth in 2025

Koh Samui’s property market is experiencing a meaningful boom, driven by strong international demand and a limited supply of both condos and villas.As of mid-2025, the island presents a compelling investment possibility, offering comparatively attractive pricing against other major Thai tourist destinations and global hotspots. This report provides an in-depth analysis of the current market dynamics, future projections, and key trends shaping Koh Samui’s real estate landscape.

attractive Pricing & Strong Momentum

Compared to Phuket or Bali, Koh Samui continues to offer a more accessible entry point for investors.This competitive pricing, coupled with improving global travel conditions, is fueling sustained momentum. Colliers anticipates this positive trend will continue, supported by ongoing interest from overseas buyers.

Developers Respond to Growing Demand

Recognizing the burgeoning investor base, several developers are accelerating their project pipelines. Supalai Plc, for example, is launching an exclusive eight-unit beachfront villa development, with prices ranging from 17.5 to 26.5 million baht per unit.

This surge in development is a direct response to the market’s appetite. In the first half of 2025,only three active condo projects totaling 876 units (worth 3.66 billion baht) were available. The entry of a 218-unit project in Bo Phut, developed by a Chinese firm, saw an impressive 73% sales rate, including entire buildings purchased by foreign investors.

Condo Supply: A Tight Market

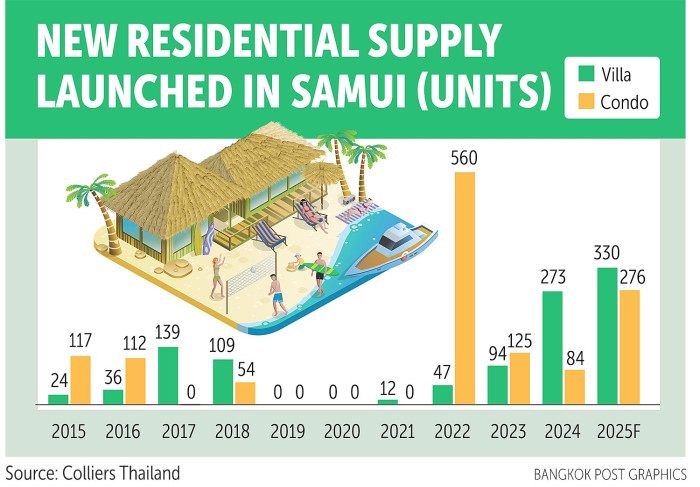

the condo market is particularly constrained. Several projects have sold out remarkably quickly – some within just nine months - highlighting the robust demand. Two additional condo launches are planned for the second half of 2025, adding 276 units to the year’s supply.

Pricing for condos generally falls between 60,000 and 80,000 baht per square meter. However, premium offerings, capitalizing on desirable locations and features, are exceeding 200,000 baht per sq m.

Foreign Buyers Dominate the Condo Market

Foreign buyers are the primary drivers of condo sales, representing a significant 85-90% of purchasers. These buyers fall into two main categories: tourists seeking second homes and investors targeting rental income in a market characterized by limited supply. Thai purchasers currently represent only 10-15% of the market, primarily local business owners and professionals.

Villa Market: A Vibrant Expansion

The villa segment is experiencing even more dynamic growth. As of mid-2025, 52 active villa projects offer 597 units, collectively valued at over 14.8 billion baht – a substantial 63.5% increase from the previous period.

This expansion is fueled by 18 new villa projects launched in the first half of the year, adding 179 units to the market.Colliers forecasts over 15 further villa project launches in the second half of 2025, bringing the total new supply for the year above 330 units.

The success of leasehold villa projects is particularly noteworthy, with some selling 46 units within a mere two months of launch.

Regional Performance & Buyer Demographics

Sales rates vary across the island. Chaweng-Bo Phut currently leads with a take-up rate of nearly 68%, followed by Lamai at 49% and Mae Nam at 36%.

over 90% of villa buyers are foreign,with investors from Australia,Europe (particularly the UK and Germany),Israel,South Africa,Czechia,and France leading the charge. Demand remains strongest for high-end properties offering sea views,privacy,and convenient access to amenities. Developers are responding by diversifying villa designs to cater to a wider range of lifestyle and investment preferences.

Occupancy Rates & Future Outlook

As of mid-2025, nearly 80% of available condo units (699 out of 876) have been sold, a 4.4 percentage point increase from the previous period. This high absorption rate is prompting developers to plan additional phases to meet the continued demand.

“Samui remains one of Thailand’s top destinations for luxury holiday homes and property investment,” concludes Phattarachai, “supported by rising demand, increasing prices, and sustained international interest.”

Expert Insight: The Koh Samui property market is