navigating the 2026 Small Business health Insurance Landscape: Understanding ACA Premium Increases

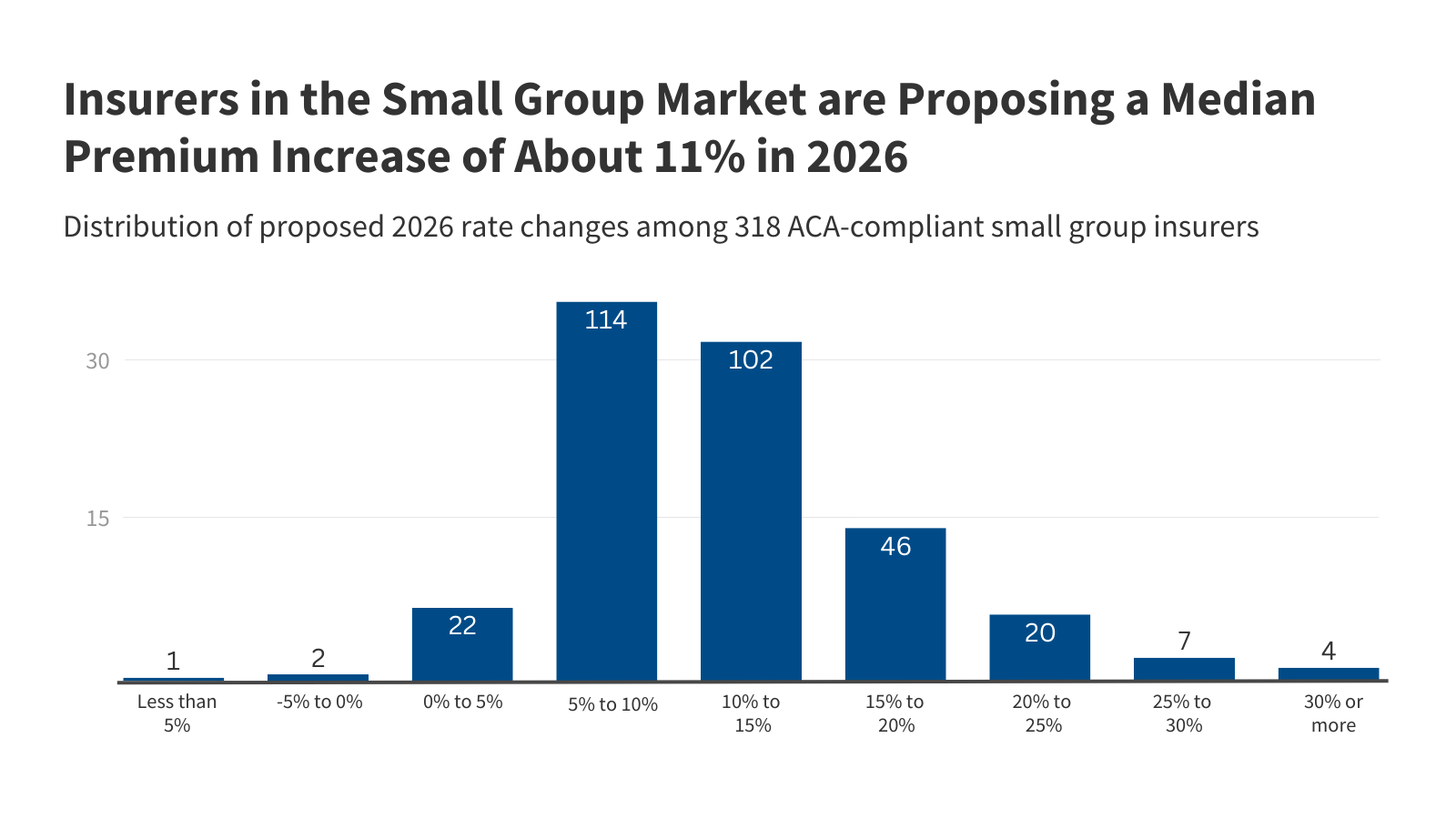

The future of employee benefits is a constant concern for small business owners. Recent projections indicate a meaningful shift in the health insurance market, specifically impacting those offering Affordable Care Act (ACA)-compliant plans. According to a thorough analysis by the Peterson-KFF Health System Tracker, small businesses can anticipate a median premium increase of 11% for 2026. This isn’t just a number; it represents a tangible financial challenge for businesses striving to provide competitive benefits packages while managing operational costs. This article will delve into the factors driving these increases, explore the implications for small businesses, and offer strategies for navigating this evolving landscape. We’ll examine the nuances of these rate hikes, going beyond surface-level explanations to provide actionable insights for informed decision-making.

Understanding the projected Premium Increases

The 11% median increase isn’t uniform across the country. Preliminary rate filings from 318 insurers across all 50 states and the District of Columbia reveal a complex picture. A deeper analysis of 16 states and D.C.shows a proposed median increase of 12%. This variance highlights the localized nature of healthcare costs and regulatory environments.

| Metric | National Median | 16-State/DC Median |

|---|---|---|

| Projected Premium Increase (2026) | 11% | 12% |

| primary cost Driver | Rising Healthcare Costs | Rising Healthcare Costs |

| Key Contributing Factors | Hospital Care,Physician Services,Prescription Drugs,Inflation,Labor Shortages | Hospital Care,Physician Services,Prescription Drugs,GLP-1 Drug Costs,Decreased enrollment |

The Core Drivers of Rising Healthcare Costs

The primary culprit behind these premium increases is, unsurprisingly, rising healthcare costs.But what specifically is driving those costs? Several key factors are at play:

* Hospital Care: Consolidation within the hospital industry continues to reduce competition, allowing for higher prices. I’ve personally witnessed this in my consulting work with several regional hospital systems - the lack of negotiating power for smaller employers is a significant disadvantage.

* Physician Services: The increasing cost of medical education and practice overhead contributes to higher physician fees. Specialty care, in particular, is experiencing significant price increases.

* prescription Drug Costs: This is a notably volatile area. the introduction of expensive specialty drugs, like GLP-1 receptor agonists (Ozempic, Wegovy, Mounjaro) for diabetes and weight loss, is considerably impacting overall drug spending.Some insurers are already responding by excluding coverage for these drugs when prescribed for weight loss, a controversial move we’ll discuss later.

* Inflation & Labor Shortages: Broader economic factors, including inflation and shortages of healthcare professionals, are driving up operational costs for insurers and providers alike.

* Risk Pool Dynamics: Decreased enrollment in small group plans,coupled with a potentially sicker risk pool (meaning the people enrolled have higher healthcare needs),can lead to higher premiums. this is a classic example of adverse selection.

The Impact of GLP-1 Drugs on Health Insurance Premiums

The surge in demand for GLP-1 drugs is a particularly noteworthy factor. These medications, initially developed for diabetes management, have gained immense popularity for weight loss. While offering significant health benefits for some, their high cost is putting pressure on health plan budgets.

As a result, a growing number of insurers are