Navigating UAE Corporate Tax: avoiding Costly Mistakes & Ensuring Compliance

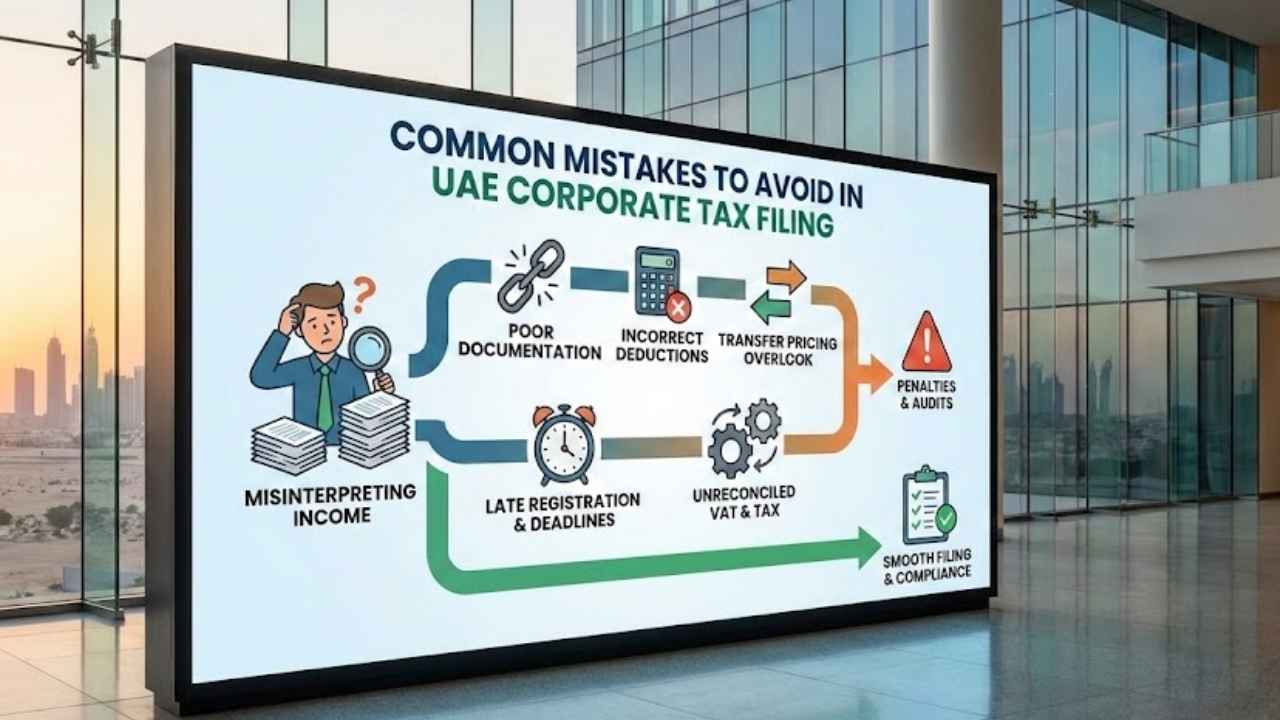

The introduction of Corporate tax (CT) in the UAE marks a significant shift for businesses across the Emirates. While designed to diversify government revenue and align with international standards,it also introduces a new layer of complexity for financial management. Many companies, particularly Small and Medium Enterprises (SMEs), are finding themselves vulnerable to penalties and lost revenue simply due to misunderstandings or oversights in their CT obligations.

This extensive guide, informed by extensive experience assisting businesses with UAE tax compliance, outlines the most common pitfalls and provides actionable strategies to ensure a smooth and efficient CT journey. We’ll delve into areas frequently enough underestimated, offering practical advice to safeguard your financial health and maintain a strong relationship with the Federal Tax Authority (FTA).

Why Proactive Compliance is Crucial

The UAE’s tax landscape is evolving. A reactive approach to CT can lead to significant financial repercussions, including penalties, interest charges, and even lengthy audits. Investing in proactive compliance – understanding the rules, implementing robust internal processes, and seeking expert guidance – is not merely a cost of doing business, but a strategic investment in your company’s long-term success.

1. Incorrect Expense Categorization & Deductions: A Common Source of errors

One of the most frequent areas of concern is the proper categorization of business expenses. The UAE CT legislation clearly defines what is deductible and what isn’t. Simply put, claiming expenses that don’t meet the criteria, or miscalculating allowable deductions, can quickly lead to issues.

Non-Deductible Expenses: Be acutely aware of expenses explicitly disallowed, including:

* Entertainment Costs: Generally, entertainment expenses are not deductible.

* Penalties & Fines: Financial penalties imposed by regulatory bodies are typically non-deductible.

* Personal Use Costs: Expenses with a personal element cannot be claimed as business deductions.

Deductible Expenses (with caveats): Expenses like staff costs, operational expenses, and depreciation are deductible, but require meticulous record-keeping and adherence to specific calculation methods outlined in the CT law. for example, depreciation must be calculated using approved methods and rates.

For SMEs: The lack of dedicated in-house tax expertise often exacerbates this issue. Our recommendation: Develop a clear, documented internal policy for expense categorization, reviewed and validated by a qualified tax professional. This policy should include detailed examples and training for relevant staff.

2. Overlooking Transfer Pricing Requirements: Beyond Multinational Corporations

A surprisingly common misconception is that transfer pricing rules only apply to large multinational corporations. This is demonstrably false under UAE regulations. Any business engaging in transactions with related parties – whether locally or internationally – must comply with transfer pricing rules.

Related parties include:

* Businesses owned or controlled by the same individuals.

* Entities with significant ownership overlap.

* Family-owned businesses.

Key Requirements:

* Arm’s Length Principle: Transactions must be priced as if they were conducted between independent parties.

* Transfer Pricing Documentation: Comprehensive documentation justifying your transfer pricing methodology is mandatory. This includes a detailed analysis of comparable transactions and economic conditions.

* Timely Disclosure: transfer pricing disclosures must be submitted to the FTA within the prescribed deadlines.

The Risk of Non-Compliance: Ignoring transfer pricing requirements can trigger lengthy tax assessments, potential adjustments to your taxable income, and substantial penalties.

3. Late or Incorrect Tax Registration: Don’t Delay Compliance

Prompt and accurate tax registration is essential. A common mistake is assuming exemption or misinterpreting registration deadlines. The FTA has been unequivocal: all taxable persons must register for Corporate Tax within the specified timeframe,regardless of income level or free zone status.

Consequences of Late Registration:

* Financial Penalties: Late registration attracts significant fines.

* Delayed Filing: You cannot file your CT returns correctly or on time without proper registration.

* Administrative Burden: addressing registration issues after the deadline adds needless complexity.

Actionable Step: Verify your registration obligations immediately. If you are unsure, consult with a tax advisor to ensure you meet all requirements.

4. Missing Filing Deadlines: A costly Oversight

Just like Value Added Tax (VAT), missing Corporate Tax filing deadlines carries substantial penalties.The timelines are fixed, and late submission penalties accumulate rapidly.

Best Practices:

* Internal Compliance Calendar: Implement a clear internal calendar outlining all CT filing and payment deadlines.