“`html

ACA Marketplace Tradeoffs: Navigating Premiums and Deductibles in 2026

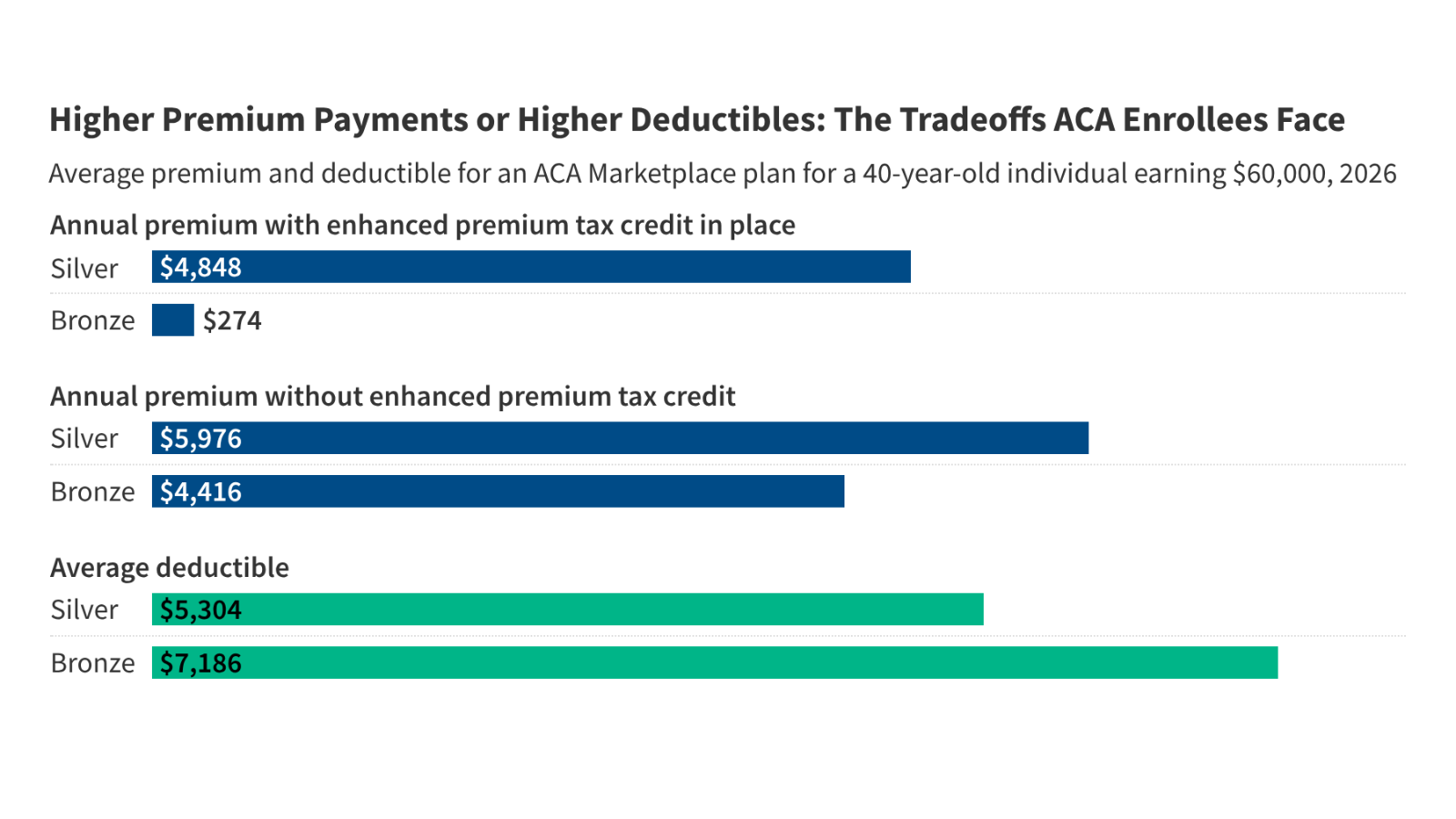

As the affordable Care Act (ACA) Marketplace enters 2026, many enrollees are facing a critical decision: choosing between health insurance plans with lower monthly premiums but higher out-of-pocket costs, or plans with higher premiums and lower deductibles. This shift is largely due to the expiration of enhanced premium tax credits at the end of 2025, prompting individuals to reassess their coverage options and financial trade-offs.

The Impact of Expiring Tax Credits

The ACA’s enhanced premium tax credits have played a significant role in making health insurance more affordable for millions of Americans. With these credits set to expire, many enrollees are experiencing a ample increase in their monthly premiums [1].This has led to a greater focus on the balance between monthly costs and potential out-of-pocket expenses.

Understanding Plan Tiers: Silver vs. Bronze

A common strategy for managing costs is switching between plan tiers. Silver plans generally offer a balance between premiums and cost-sharing,while Bronze plans typically have the lowest monthly premiums but the highest deductibles and other cost-sharing requirements.

Silver Plans

Silver plans frequently enough include cost-sharing reductions for individuals with lower incomes, which can considerably reduce deductibles and copayments. However, as tax credits expire, the overall cost of a Silver plan may become prohibitive for some.

Bronze plans

Switching to a Bronze plan can lower premium payments, but it’s crucial to understand the implications. Bronze plans have higher deductibles, meaning enrollees must pay more out-of-pocket before their insurance coverage kicks in.They also typically have higher copays and coinsurance, potentially leading to substantial financial burdens if significant medical care is needed [2].

Section 1557 and Non-Discrimination

It’s significant to remember that regardless of the plan chosen,all health programs and activities receiving federal financial assistance are prohibited from discriminating based on race,color,national origin,sex,age,or disability,as outlined in Section 1557 of the Affordable Care Act [[[1]]. This ensures equitable access to healthcare services for all individuals.

key Considerations When Choosing a Plan

- Healthcare Needs: consider your anticipated healthcare utilization. If you have chronic conditions or expect to require frequent medical care, a plan with lower out-of-pocket costs (even with a higher premium) may be more beneficial.

- Financial Situation: Evaluate your budget and ability to cover potential deductibles,copays,and coinsurance.

- Income Eligibility: explore whether you qualify for any remaining subsidies or financial assistance programs.

The Affordable Care Act: A Brief Overview

the Affordable care Act (ACA), enacted in March 2010, aimed to expand health insurance coverage and improve access to care for millions of Americans [[3]]. Key provisions include the expansion of Medicaid, the creation of health insurance marketplaces, and protections for individuals with pre-existing conditions [[[2]].

Looking Ahead

The expiration of enhanced premium tax credits presents a challenge for many ACA Marketplace enrollees. Carefully evaluating plan options,understanding the trade-offs between premiums and deductibles