US-India Trade Tensions Escalate: A Looming Economic Headwind for India

Recent tariff hikes announced by former President Trump are casting a shadow over the US-India trade relationship, perhaps disrupting India’s economic momentum. What began as a pursuit of closer ties and special trade considerations has quickly devolved into a dispute with important implications for businesses and consumers on both sides. This article breaks down the situation, its causes, and what it means for your understanding of the global economic landscape.

A Shift in Dynamics: From ”Special Bond” to Trade Barriers

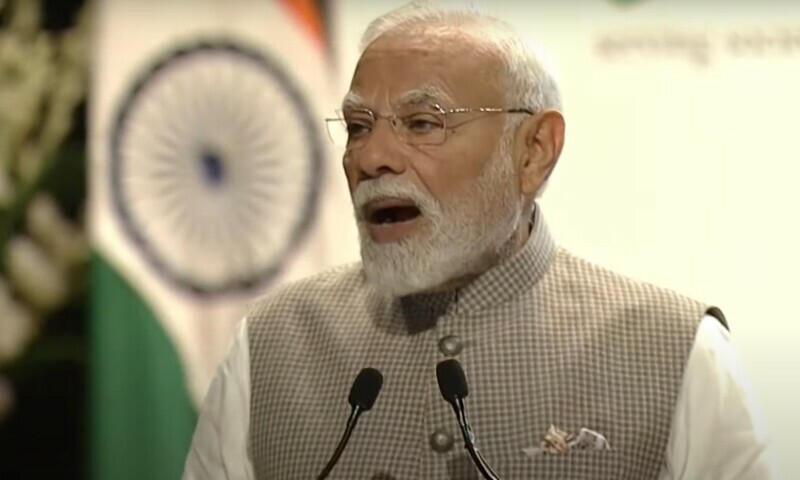

for years, successive US administrations have viewed India as a crucial partner, particularly as a counterbalance to China’s growing influence. The world’s most populous nation and fifth-largest economy, India holds immense strategic importance. Former President Trump himself acknowledged a “special bond” with Prime Minister Modi during a 2024 visit, even praising Modi’s negotiating skills.

Though, this perceived camaraderie hasn’t translated into favorable trade terms. Instead, the US has recently imposed escalating tariffs on indian goods, triggering a retaliatory response from New Delhi. This marks a significant departure from earlier hopes for preferential tariff treatment.

The Spark: Dairy imports and Reciprocal Tariffs

The immediate catalyst for the current tensions appears to be US demands for greater access to India’s dairy market. New Delhi is hesitant, fearing that allowing dairy imports could offend the cultural and religious sensitivities of India’s majority Hindu population, who revere cows.

This resistance prompted the US to implement a 25% tariff on certain Indian products, which has now been increased to 50% on a wider range of goods. India has responded with reciprocal tariffs, further escalating the conflict.

Impact on Indian Exporters: A “Severe Setback”

The impact on Indian businesses is already being felt. S.C. Ralhan, president of the Federation of Indian Export Organisations (FIEO), described the situation as a “severe setback.” Here’s a breakdown of the key concerns:

Reduced Competitiveness: The 50% reciprocal tariff places Indian exporters at a 30-35% competitive disadvantage compared to those from countries with lower tariffs.

Order Cancellations: Many export orders are already being put on hold as buyers reassess their sourcing strategies.

Thin Margins: For small and medium-sized enterprises (smes), already operating with tight profit margins, absorbing these increased costs is “simply not viable.”

significant Market Exposure: The US is India’s largest trading partner, accounting for $87.4 billion in goods shipped in 2024. This makes the Indian economy particularly vulnerable to US trade policies.

Economic Forecasts: A Downgrade in Growth Potential

Analysts are already revising their economic forecasts for India. Capital Economics estimates that US spending contributes roughly 2.5% to India’s GDP.

The imposition of these tariffs could reduce India’s economic growth by as much as 1 percentage point, potentially bringing growth down to 6% this year and next, compared to a previously forecast 7%.This slowdown could significantly impact job creation and investment.

India’s Strategic Maneuvering: Looking East?

Amidst the escalating trade tensions with the US, India appears to be strengthening its ties with other global powers. Reports suggest Prime Minister Modi may visit China in late August – his first visit since 2018.

This move, following a meeting with Chinese President Xi Jinping in Russia last October, signals a potential shift in India’s foreign policy. India remains a significant buyer of discounted Russian oil, saving billions of dollars. These strategic decisions demonstrate India’s intent to diversify its partnerships and reduce its reliance on any single nation.

What Does This Meen for You?

The US-India trade dispute is a reminder of the interconnectedness of the global economy. As a business owner, investor, or simply someone interested in global affairs, it’s crucial to understand these developments.

Supply Chain disruptions: Expect potential disruptions to supply chains, particularly for industries reliant on trade between the US and India.

Increased Costs: Consumers may see increased prices for certain goods as tariffs are passed on.

* Geopolitical Shifts: The evolving relationship between the