The ACA Marketplace: A Vital Safety Net for Small Businesses, the Self-Employed, and Beyond

The Affordable Care Act (ACA) Marketplaces have become a cornerstone of health insurance coverage for millions of Americans, particularly those navigating the complexities of self-employment or small business ownership.Understanding who utilizes these marketplaces and the potential impact of upcoming policy changes is crucial for individuals and policymakers alike. This article dives deep into the current landscape of ACA enrollment, highlighting its significance and outlining what the future may hold.

Who is Enrolling in the ACA Marketplaces?

Contrary to common assumptions, the ACA isn’t solely for those without employer-sponsored insurance. Actually, nearly half of all adults with coverage through the ACA individual market are small business owners, employees of small businesses, or self-employed individuals.this demonstrates the marketplace’s critical role in supporting the backbone of the American economy.

Here’s a closer look at workforce participation:

* Around 8% of adults under 65 who consistently work over 20 hours a week obtain their health insurance through the individual market.

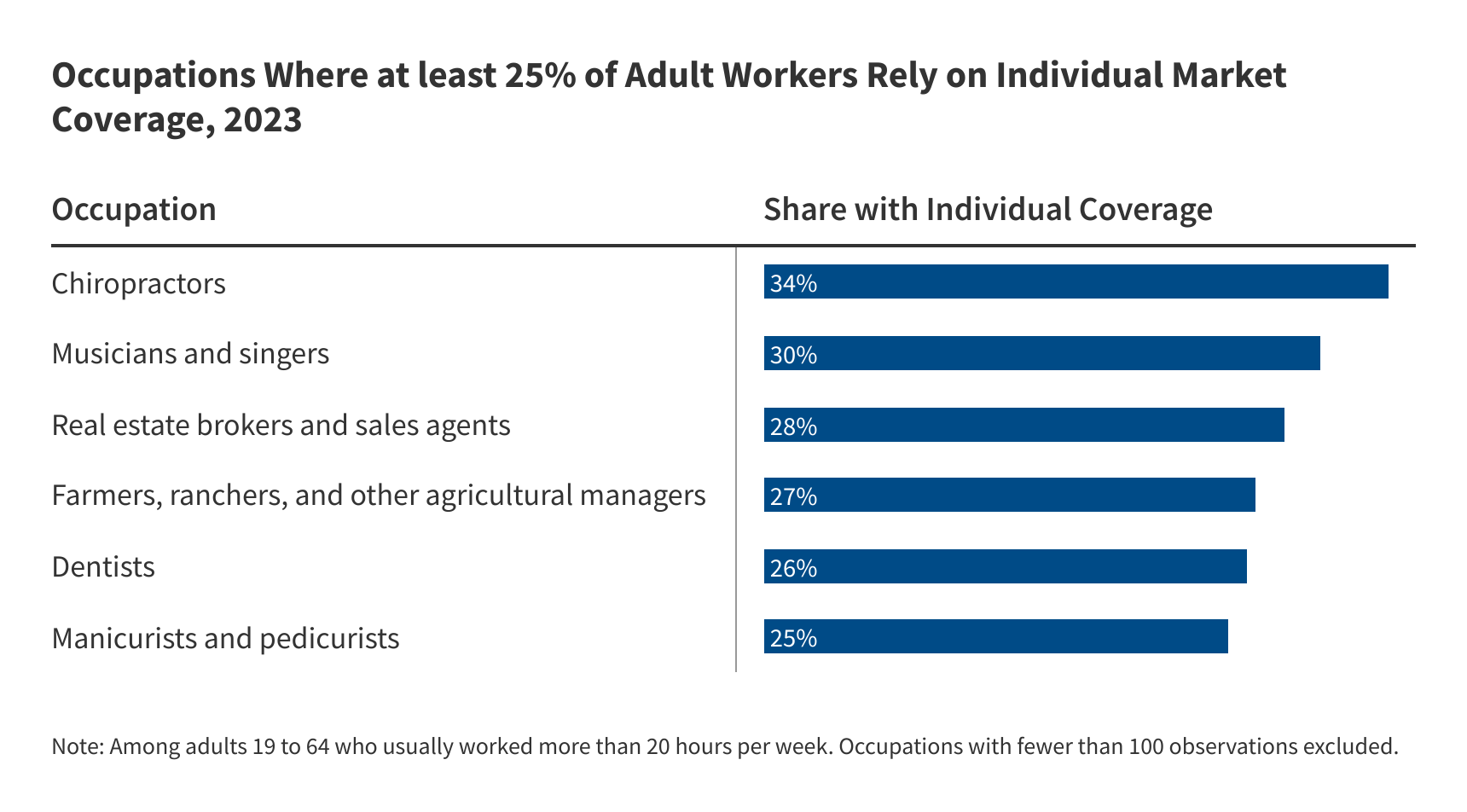

* Certain professions rely heavily on the ACA marketplaces, including:

* Chiropractors and dentists

* Real estate brokers

* Farmers, ranchers, and agricultural managers – where over a quarter of workers are covered through the individual market.

How People Access and Afford Coverage

The vast majority – over 90% – of individuals enrolling in the individual market do so through the ACA Marketplaces. This streamlined process offers a centralized platform for comparing plans and determining eligibility for financial assistance.

And that assistance is meaningful. Currently, 93% of marketplace enrollees receive a tax credit to lower their monthly premiums. These credits make coverage substantially more affordable,opening access to healthcare for those who might otherwise be priced out.

the Impact of Enhanced Premium Tax Credits

For the past five years, enhanced premium tax credits – introduced through the Inflation Reduction Act – have further reduced monthly premiums. These credits extended financial help to individuals with middle and higher incomes who previously didn’t qualify. This expansion has been a game-changer, ensuring more people can access affordable health insurance.

Though, these enhanced credits are scheduled to expire at the end of 2025. What happens then?

* Premium Increases: If the credits expire, individuals currently receiving them will face a sharp increase in their out-of-pocket premium payments – averaging over 75%.

* Increased Uninsured Rates: The Congressional Budget Office (CBO) estimates that nearly 4 million more Americans coudl become uninsured.

* Cost of Extension: Extending the enhanced tax credits would cost an average of $35 billion per year, a significant investment in accessible healthcare.

Understanding the Data

The insights presented here are based on a thorough analysis of the 2023 American Community Survey conducted by the Kaiser Family Foundation (KFF).

Here’s how the data was interpreted:

* Individual Market Coverage: individuals were categorized as having individual market coverage if they reported directly purchasing a plan and didn’t report having other coverage options.

* Work Status: Percentages are calculated based on adults aged 19-64 who typically work more than 20 hours per week. Individuals with multiple coverage types (e.g., employer-sponsored and individual market) were categorized based on their primary coverage source.

What This Means for You

Whether your a small business owner, self-employed, or simply seeking affordable health insurance, the ACA Marketplace offers a vital safety net. Staying informed about potential changes to premium tax credits is crucial.

Here’s what you can do:

* Explore your options: Visit Healthcare.gov to browse plans and estimate your potential tax credits.

* Stay informed: Follow updates from KFF (https://www.kff.org/affordable-care-act/) and other reputable sources.

* Advocate for continued access: Contact your elected officials to express your support for policies that ensure affordable healthcare for all.

the future of the ACA Marketplace – and the