The Reiner Family Tragedy and the Slayer Rule: Understanding Inheritance and Criminal Investigations

The recent deaths of acclaimed director Rob Reiner and his wife, Michele Singer Reiner, have understandably drawn significant media attention. Simultaneously, their son, nick Reiner, is under investigation in connection with their passing. This situation raises complex legal questions, especially regarding inheritance and a legal principle known as the “slayer rule.” As an estate planning attorney with decades of experience, I’ll break down what this means for the Reiner family and for you, shoudl you ever be considering similar estate planning scenarios.

What is the Slayer Rule?

Essentially, the slayer rule prevents someone who intentionally causes the death of another person from inheriting from that person’s estate.It’s a fairly straightforward concept rooted in public policy – you shouldn’t profit from a wrongful act.

* The rule applies irrespective of the victim’s wealth.

* It exists in some form in most U.S. states, including California, where the Reiners resided.

* The key element is intentional killing; accidental deaths or those resulting from self-defense typically don’t trigger the rule.

Why is This Case Receiving So Much Attention?

Typically, cases involving the slayer rule remain relatively quiet until the criminal and probate proceedings unfold. However, the Reiners’ high profile and significant wealth – reportedly around $200 million – have amplified media coverage. When significant assets are involved, inheritance disputes often become public, attracting scrutiny during both criminal trials and subsequent estate litigation.

Who Stands to Inherit the Reiner Estate?

At this point, it’s simply too early to definitively say who will ultimately inherit from Rob and Michele Reiner. Estate plans are often complex and can involve more than just a simple will.

* Wills are public record, but the Reiners may have utilized trusts.

* Trusts offer privacy and can be particularly useful for celebrities with valuable intellectual property rights, like copyrights to films and television shows.

* it’s common for parents to leave the majority of their fortune to their children.

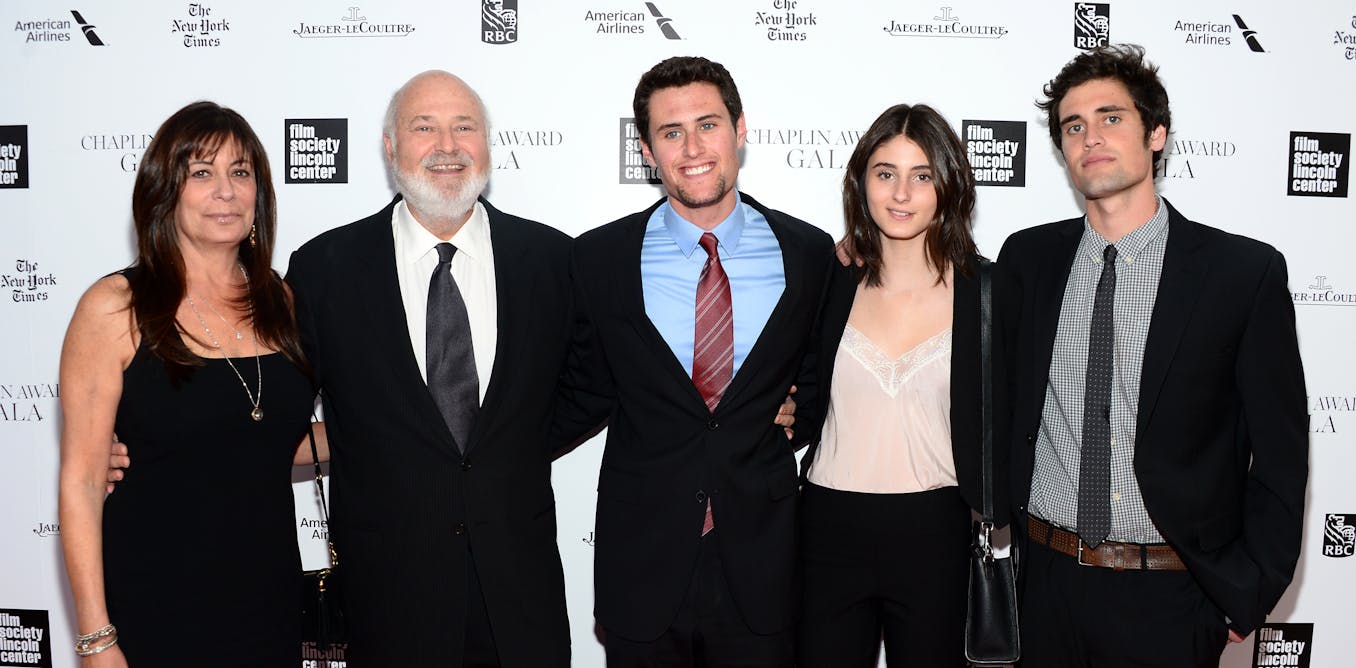

rob and Michele Reiner had three children together: Nick, romy, and Jake. Additionally, Rob Reiner adopted a daughter, Tracy, from a previous marriage to Penny Marshall. It’s also possible the Reiners included charitable donations in their estate plans, as they where known supporters of various causes, including early childhood development.

Could the Slayer Rule Apply to Nick Reiner?

This is the central question surrounding the case, and it’s one we simply can’t answer definitively right now. It’s crucial to remember that the Reiners’ wills and estate planning documents haven’t been publicly released. Therefore, the extent of any potential inheritance for Nick Reiner, even without the slayer rule, remains unknown.

More importantly, the investigation into their deaths is ongoing. It’s vital to avoid making any assumptions about Nick Reiner’s guilt or innocence. Everyone is presumed innocent until proven guilty in a court of law.

What About Legal Fees?

Recent reports indicate that an unnamed source claims the Reiner family is covering Nick Reiner’s legal expenses. This isn’t unusual in high-profile cases, as families often want to ensure their loved ones have adequate legal representation, regardless of the circumstances.

Understanding Estate Planning and Potential Complications

This tragic situation underscores the importance of comprehensive estate planning. If you’re considering your own estate plan, here are a few key things to keep in mind:

* Wills vs. Trusts: Understand the differences and benefits of each.

* Beneficiary Designations: ensure your beneficiary designations on accounts (retirement, life insurance, etc.) align with your overall estate plan.

* Contingency Planning: Consider what happens if a beneficiary predeceases you or is involved in a legal issue.

* Regular Review: Estate plans should be reviewed and updated periodically to reflect changes in your life, family, and financial situation.

Disclaimer: I am an attorney, but this information is for general educational purposes only and does not constitute legal advice. Every situation is unique, and you should consult with a qualified attorney to discuss your specific legal needs.