#Wills #higher #VAT #overnight #stay #fivestar #hotel

The State charges 23% VAT for an inventory process or a will, which are mandatory procedural acts for many people. However, they only charge 5% for a night’s stay in Madeira in a five-star hotel.

The State charges 23% VAT on inventory processes, wills and qualifications of heirs, procedural acts and procedures to which many people are obliged, without the possibility of being able to escape when going to a notary office or a registry office. But, without any obligation, people will be able to sleep in a five-star hotel on the continent and only pay 6% VAT. In Madeira they will pay 5% and only 4% in the Azores.

“It is unfair”, considers the president of the Order of Notaries (ON), stressing: “It is not reasonable for the legislator to equate, with regard to the collection of VAT, access to Law and Justice, constitutionally guaranteed, the acquisition of any consumer good or service, that is, the application of a maximum rate of 23%”.

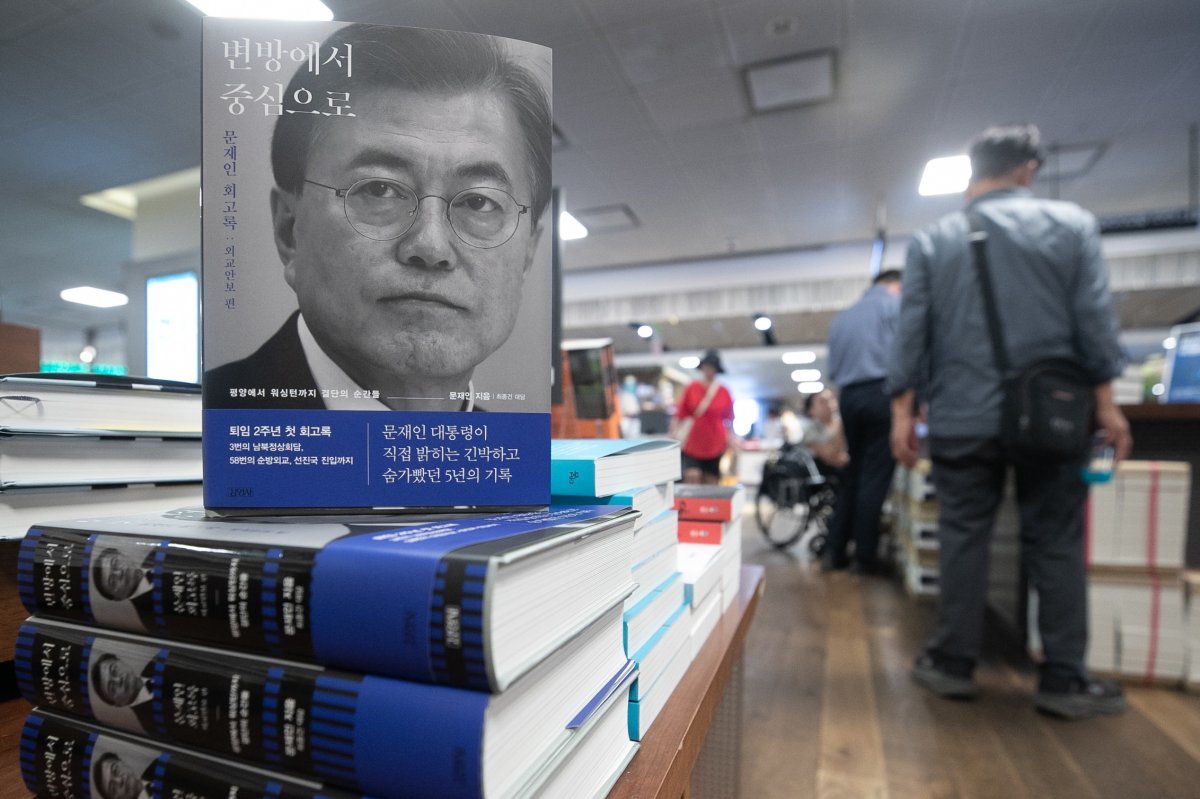

In this sense, ON sent to the political parties running for elections, and which had parliamentary seats, some suggestions for the justice sector, proposing, in particular, the exemption from VAT for procedural acts and procedures considered unavoidable in certain situations, such as , inventory processes, wills, qualifications of heirs, irrevocable powers of attorney and extrajudicial sharing – “taking into account the underlying public interest and the inevitability of access to such services”, explains the president (in the photo).

ON also proposes the application of a reduced rate of 6% VAT to other services provided by notaries, lawyers and solicitors. For example, authentication of documents, simple powers of attorney, property purchase and sale contracts, mortgages, sharing of inheritances, sharing of assets due to divorce, etc.

ON, according to Jorge Batista da Silva, would also like it to go further and VAT to disappear from all legal processes. “The State does not have to make money from justice. This is a constitutional right”, he said, highlighting: “It is natural to pay for the resolution of a dispute, but it is impossible to defend that 23% VAT should be paid on the value of the service, as if it were a whiskey” . For the president, the “State cannot use justice as a source of profit. It is immoral and unconstitutional.” And he stated: “In inventory processes, which is an imperative process, 23% VAT is a complete aberration. This must end immediately. The State should have put an end to this by now.” In his opinion, “no one knows why it didn’t end up taking into account the fact that it is not within the scope of competition”. “In the worst case scenario, everything should be reduced to 6%, until a solution is found so that it becomes zero”, he defended.

ON also proposed to politicians the dejudicialization of inventories due to death and divorce. This measure would imply the creation of a new simplified inventory regime, under which the process will be promoted in Notary Offices and Courts, at the same time, maintaining the competences of each one, but taking advantage, for this purpose, of interoperability between ON’s Inventory Processing Platform and the Citius Platform, from the Ministry of Justice. In other words, both entities worked at the same time on the same process via IT.

These and other ON proposals were presented to political parties when they already had their electoral programs closed. Because, explained the president, “regardless of who wins the elections, all these proposals are in line with what any government wants for public administration”.