The global economic landscape is constantly shifting, and a key indicator of this change lies in the market capitalization of the world’s largest companies. Currently, the technology sector dominates, but a diverse range of industries contribute to the top rankings. Understanding these shifts provides valuable insight into the forces shaping our world, especially within the global market capitalization, which reached over $100 trillion in early 2024.

The Shifting Sands of Market leadership

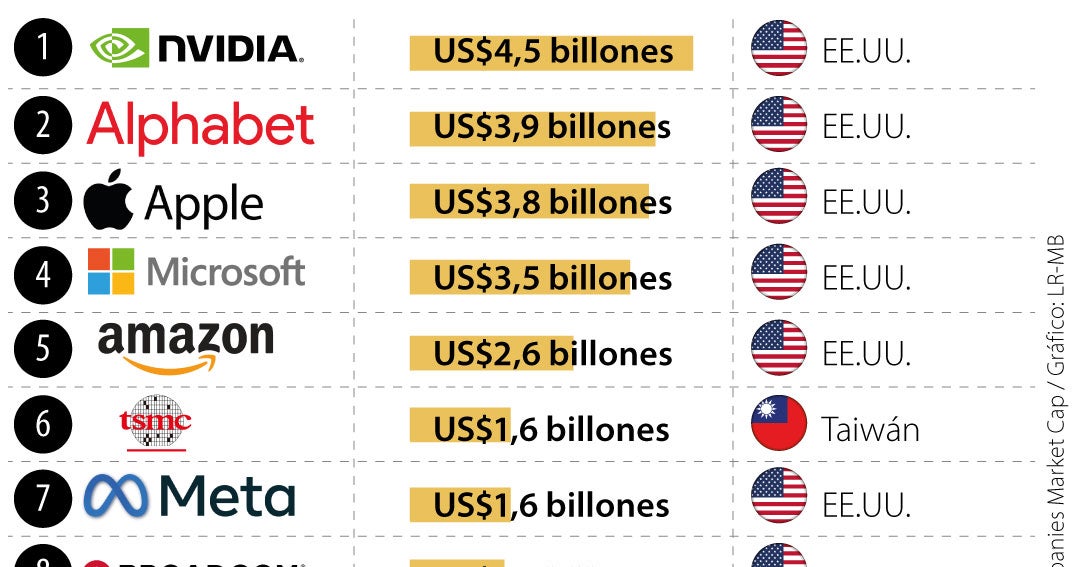

Alphabet,the parent company of Google,has ascended to the top spot,surpassing Apple in market capitalization. This change reflects investor confidence in Alphabet’s innovative ventures and it’s continued dominance in search and online advertising. As of January 9, 2026, Alphabet boasts a market cap exceeding $1.83 trillion, a testament to its enduring influence.

Apple, while relinquishing the top position, remains a formidable force with a valuation around $1.78 trillion. The company’s loyal customer base and ecosystem of products continue to drive significant revenue, though growth has faced headwinds in recent quarters.I’ve found that Apple’s ability to innovate and maintain premium pricing will be crucial for its future success.

Microsoft secures the third position, demonstrating the enduring relevance of software and cloud computing. With a market capitalization of approximately $1.72 trillion, microsoft’s strategic investments in artificial intelligence and its Azure cloud platform are attracting notable investor attention. Here’s what works best: focusing on long-term growth potential rather than short-term fluctuations.

Saudi Aramco, the national oil company of Saudi Arabia, holds the fourth spot, valued at around $1.65 trillion. Its position underscores the continued importance of fossil fuels in the global energy mix, despite the growing momentum of renewable energy sources. The company’s low production costs and vast reserves contribute to its substantial valuation.

The Semiconductor Sector’s Rising Influence

Nvidia, a leading designer of graphics processing units (GPUs), has experienced explosive growth, securing the fifth position with a market cap of approximately $1.35 trillion.The demand for Nvidia’s chips, driven by the artificial intelligence boom and the growth of data centers, has propelled its valuation to unprecedented levels.Did you know? Nvidia’s stock has increased over 200% in the last year alone (as of December 2025).

TSMC (Taiwan Semiconductor Manufacturing Company) occupies the sixth position,a major manufacturer of semiconductors from Taiwan. Its presence in the top 10 highlights the strategic importance of the chip industry,especially amidst geopolitical tensions and technological competition. TSMC is a key partner for companies like Apple and Nvidia, giving it significant weight in the global economy.

Meta Platforms, in seventh place, has rebounded after a period of adjustments and cost-cutting measures. The resurgence of its advertising business and a more efficient operational